Assessing your land eligibility

Date published: 21 December, 2022

For recent changes to this guidance, please see the bottom of the page.

Table of Contents

- Introduction

- Assessment of land

- Land used for woodland creation

- Technical assessment

- Technical assessment examples

- Technical assessment of an ineligible feature within a parcel

- Technical assessment of a TOID

- Recent changes

- Previous versions

- Download guidance

Introduction

The purpose of this guidance is to help you assess what land is ineligible for funding under the Basic Payment Scheme. We would advise that you read this guidance in conjunction with Mapping rules for land managers.

Responsibility

It is your responsibility as the applicant to ensure that you only claim eligible areas on your Single Application Form and that any ineligible features have been excluded. This can be done by either applying to have them mapped out of the parcel through submitting a Land Maintenance Form (PF06) or by reducing the claimed area.

Eligible land

Under the Basic Payment Scheme, eligible land is:

- arable land

- permanent crops or permanent pasture on which the production, rearing or growing of agricultural products is undertaken

- maintaining the land under Good Agricultural & Ecological Condition (GAEC)

Ineligible non-agricultural land

This is land that consists of ineligible non-agricultural area such as:

- rock and scree

- roads, tracks, paths and hard standings

- buildings, including steadings, yards, hard standings, houses and garden sites

- water features such as ponds, watercourse’s, lochs, lochans and rivers

- dense vegetative cover such as impenetrable gorse, scrub or monoculture stands of bracken with no forage at the base

- foreshore and marsh

- trees

This land also includes non-agricultural activities that affect agricultural activity, such as gravel extraction, land in-fill or pipelines. If you have these activities then you must measure them and deduct them from your claimed area.

Making accurate deductions

Land managers who submit a Single Application Form should assess every parcel they declare with regards land eligibility and ensure they make accurate deductions for ineligible features.

Through making accurate assessments of the ineligible land cover within a parcel, you will be able to determine the maximum eligible area to claim.

Declaring ineligible land on the Single Application Form

There is no requirement to declare ineligible land within a parcel on the Single Application Form under the unclaimed / other land column.

However, we encourage you to make use of this facility as it demonstrates your consideration towards assessing your land parcels. There are eleven codes available for use (see tables below) and applicants are encouraged to use them as appropriate.

| Hard features - completely ineligible | |

|---|---|

| Description | Code |

| Ponds, rivers, streams or lochs | WAT |

| Roads or yards | ROAD |

| Buildings | BUI |

| Rocks | ROK |

| Scree (areas of smaller loose rock) | SCE |

| Foreshore | FSE |

| Soft features - partially ineligible | |

|---|---|

| Description | Code |

| Bracken | BRA |

| Gorse | GOR |

| Marsh | MAR |

| Scrub | SCB |

| Trees (not including orchards or nurseries) | TREE |

Assessment of land

You should assess the areas of each land parcel covered by ineligible features.

In line with the Land Parcel Information System (LPIS) rules, permanent and defined ineligible features, such as bodies of water greater than one hectare and fenced-off house and garden sites within a parcel, may already be unregistered land.

Therefore, these do not need to be deducted from the gross area. An unregistered area within a parcel will appear on your IACS map as an area with a yellow boundary without a number to denote it has a Land Parcel Identifier.

Further information on mapping rules for unregistered land within parcels can be found in Mapping rules for land managers.

If you do not have access to a map with an aerial photography background, please contact your local area office.

Eligible internal features

Internal features such as ditches, burns and watercourses are accepted as being an eligible part of the agricultural parcel where the width is less than or equal to 2 metres. If the width of the feature is greater than 2 metres, then the area of the feature should be deducted.

Completely ineligible features

When determining the eligible area of a land parcel, you may find ineligible land cover that prevents the land meeting the eligible land definition, known as Basic Payment Scheme exclusions.

Some of these are clearly and complete exclusions, for example buildings. In this instance the entire ineligible area should be deducted from the gross area of the parcel, thus leaving you with the maximum net eligible area of the field.

Partially ineligible features

Many ineligible land cover features are not 100 per cent ineligible, such as gorse, bracken and scrub. Where dense vegetative cover is impenetrable to stock and prevents the growth of any vegetative understory for grazing then the area is ineligible for the Basic Payment Scheme and Less Favoured Area Support Scheme (LFASS) as forage.

Where land has areas where the vegetative cover is open grazeable mosaics, these areas are eligible for the Basic Payment Scheme and LFASS for forage.

As such, with gorse, bracken and scrub, a technical assessment (see Technical assessment section below) is required to assess the partial ineligible area that should be deducted from the gross area of the field.

Some types of 100 per cent permanently excluded features, such as rock, scree, water, marsh and foreshore, may also cover the land in a mosaic pattern with grazeable areas in between.

Therefore these features will also require a technical assessment to estimate eligible and ineligible areas.

Process of calculating the eligible area

A parcel that is 100 per cent usable with no ineligible features is 100 per cent eligible. This means the gross field area equals the maximum eligible area.

You should follow the next steps to calculate the maximum net eligible area:

- confirm the parcel boundary is correct; this determines the gross area of the field

- assess how much area of the parcel is covered with 100 per cent ineligible features (such as roads, rivers or buildings)

- deduct these areas from the gross area

- assess how much area of the parcel is covered with partially ineligible features (such as gorse, bracken or scrub)

- assess what percentage of each of these partially ineligible features is actually ineligible (see Technical assessment section below)

- deduct these areas from the area calculated at point three; this leaves you with the maximum net eligible area of the field

Land inspections

One of our inspectors' roles, while inspecting each claimed land parcel, is to determine the maximum eligible area. Where an inspector finds ineligible land cover, the area is mapped and deducted from the gross area of the land parcel, resulting in the maximum net eligible area.

As already described, some ineligible areas are clearly 100 per cent exclusions, such as buildings and metalled roads. In this case the entire ineligible area will be deducted from the gross area of the land parcel.

Other ineligible features, such as gorse, bracken and scrub, may cover the land in a mosaic pattern and are clearly not 100 per cent ineligible. In this instance the land inspector is required to technically assess the ineligibility of the land feature.

Land inspectors use the same procedures detailed in this guidance, though they capture this information using GPS equipment so that it can be held spatially on our mapping system for future maintenance.

Land inspectors use all the tools available to them to make assessments, including our base layer information which is MasterMap data from Ordnance Survey.

Land used for woodland creation

Please note that any land used for woodland creation will lose its eligibility for Less Favoured Area Support Scheme (LFASS) payments. Whilst there is an option to declare grazed woodlands and claim LFASS, in general, as soon as the land ceases to be classed as forage, it ceases to be LFASS eligible.

The changes to the Single Farm Payment Scheme brought about by the mid-term review of the Common Agricultural Policy included the introduction of a facility to activate Single Farm Payment Scheme entitlements on land used for the creation of a woodland. Previously, except in specific circumstances, like woodland grazing, land used for forestry was ineligible as far as the Single Farm Payment Scheme was concerned. This arrangement will continue under the Basic Payment Scheme.

It is important to be clear that not all types of forestry allow the land to be considered as Basic Payment Scheme eligible. If you wish to benefit from this new provision, you must meet the following conditions:

- the land used for the new woodland must have generated or been capable of generating a Single Farm Payment Scheme payment under the 2008 scheme. This means that the land must have been claimed for Single Farm Payment in 2008 and the business which claimed the land must also have held Single Farm Payment entitlements

- the land used for the new woodland must have been afforested for the first time after 31 December, 2008, and

- you must be in receipt of a payment or participating in:

(i) schemes under the previous Rural Development Plan (Council Reg 1257/1999), namely Woodland Grant Scheme and Farmland Premium Scheme, or

(ii) the scheme under the current Rural Development Plan (Council Reg 1698/2005), namely Woodland Creation as a Rural Priorities option, or

(iii) a national scheme which would meet the same European Commission criteria (i.e. first-time afforestation, producers are not also benefiting from an early retirement scheme and the afforestation does not involve Christmas trees). This latter sub-category (iii) could cover schemes run separately by the Forestry Commission

This arrangement is available to you for as long as your commitment to the forestry scheme continues. In other words, for so long as you continue to participate in the particular, eligible, forestry scheme and specifically the requirement to maintain the forest. For all practical purposes, providing the trees continue to stand, there is no concern with this particular test. The issue arises when the trees are felled during the period of Basic Payment Scheme eligibility as this could give rise to a conflict with the requirement that the land must be maintained in good agricultural and environmental condition to be assessed as Basic Payment Scheme eligible.

It should be noted that nothing in the operation of this particular mechanism changes the traditional assessment of the farmer's activities. Woodland creation is clearly a silvacultural activity and the facility to claim the Single Farm Payment on such land is only intended as a means to activate entitlements.

Technical assessment

The purpose of the technical assessment is to establish a percentage of ineligible ground cover within a defined area.

Ineligible ground cover is a feature which prevents the access, growth and availability of eligible, usable forage. As such, technical assessments may be required for gorse, bracken and scrub.

However, they may also be required on mosaics of 100 per cent ineligible features, such as water, scree, rock marsh or foreshore.

Once the boundary of the ineligible feature is identified an assessment of the percentage ineligibility can then be made.

There are two methods for carrying out a technical assessment. You may choose to use both of them depending on the situation.

- scorecards

- compression

Once the scorecard and / or compression method has been used to estimate the percentage of ineligible land cover, the result must be matched to the appropriate technical assessment band, as described below, to obtain a partial ineligible percentage.

Scorecard method

For areas that are considered to contain a mosaic or scattered features, it may be useful to apply the scorecard method to help determine the ineligible percentage. This technique is accepted as an industry standard, for example with potato tuber inspections.

Scorecards can be used to help assess the percentage ineligible area within parcels where there are numerous small bushes or clumps of scrub present and / or areas of scattered rock, giving a mosaic effect.

In these areas it is not feasible to measure the area taken up by each individual clump of vegetation or rock. The scorecard will assist in accurately identifying the percentage density or cover of the features concerned.

Scorecard procedure

- areas of the parcel which are 100 per cent eligible or ineligible should be identified. They should not be included in the scorecard assessment

- scorecards should only be used to assess entire fields if the ineligible features are present across the entire field. In the vast majority of cases the assessment will relate to a small area of the field

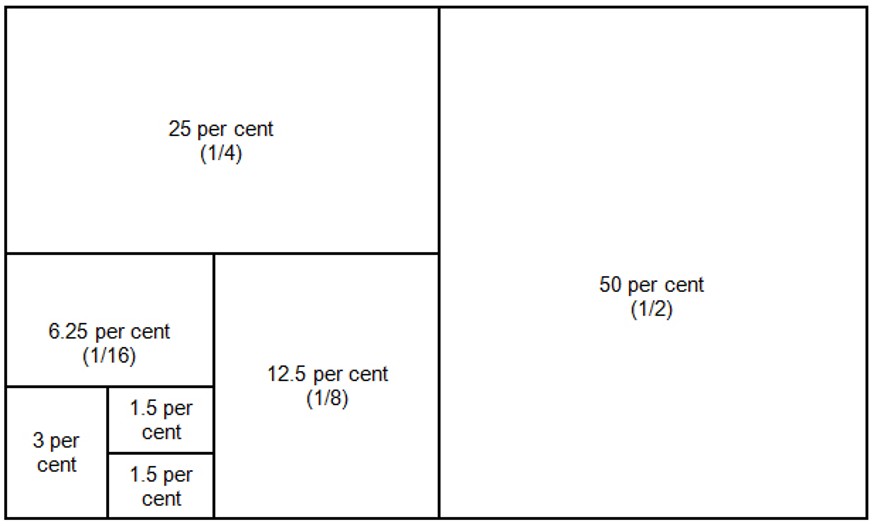

- using the scorecards below as a guide, estimate the percentage area covered by ineligible features within the area you have defined by splitting the area to be assessed into a grid 10 x 10 representing 100 squares (100 per cent). Then identifying the number of squares which are ineligible

- the percentage area of ineligible cover estimated using the scorecard method must then be matched to the appropriate technical assessment band, as described below, to obtain a partial ineligible percentage

Scorecard examples

The attached examples are based on percentage ground cover.

Where dense vegetative cover such as gorse is impenetrable to stock and prevents the growth of any vegetative understory for grazing, then the area of gorse is ineligible for the Basic Payment Scheme and LFASS as forage.

Having made a technical assessment, this ineligible area should be deducted from the gross area of the field.

Where the vegetative cover is open grazeable mosaics of gorse, then the area is eligible for the Basic Payment Scheme and LFASS as forage.

Compression method

First, assess the ineligible features on the ground within a parcel with the help of an IACS map and aerial photography. Then visually compress the ineligible features into the corner of the parcel and determine how much area is covered.

Secondly, consider what area of the ineligible feature assessed prevents the growth of eligible forage. For permanent, full exclusion features, such as rock and water, this will be 100 per cent of the area determined. For features, such as gorse or bracken, you must assess how much of the area prevents growth.

For example, dense areas of vegetation with bare ground or deep leaf litter should have high percentage of ineligibility. Whereas areas that have vegetative cover with an eligible forage understory should have a low percentage of ineligible area applied.

Assess the ineligible land cover within the defined area in front of you:

Is the ineligible cover more or less than:

- 75 per cent of the defined area?

- 50 per cent of the defined area?

- 25 per cent of the defined area?

Once you have determined a range, for example 0–25 per cent, you should further divide this.

Is the ineligible cover more or less than:

- 20 per cent of the defined area?

- 10 per cent of the defined area?

Once a more accurate range has been decided you should conclude if the ineligible feature represents the top, bottom or middle of this range with a resulting ineligible area percentage.

This percentage must then be matched to the appropriate technical assessment band as described below to obtain a partial ineligible percentage.

Area conversions

As a check, you can equate a calculated deduction area to a recognised size (an acre or a hectare). This process can be used to consider whether percentage deductions are reasonable for the ground cover and the parcel size.

| 0.01 hectares | 10 x 10 metres | 100 square metres |

| 0.05 hectares | 10 x 50 metres | 500 square metres |

| 0.10 hectares | 10 x 100 metres | 1000 square metres |

| 0.40 hectares (1 acre) | 10 x 400 metres | 4000 square metres |

| 1.00 hectare | 100 x 100 metres | 10,000 square metres |

It may be useful to measure an area in the field, for example a 10 metres x 10 metres, or the area of a farm shed then use that as the basis of a known size and relate this to calculating an area to deduct.

Technical assessment bands

To produce an accurate and consistent approach across all regions of Scotland, the technical assessment bands in the table below are applied.

After you deploy either the scorecard or compression method to derive a percentage area of ineligible land cover, this result must then be matched to the appropriate technical assessment band to obtain a partial ineligible percentage.

For example, if a land inspector considers that approximately 60 per cent of bracken found to be ineligible, it would be captured in the 50–70 per cent band and would result in a 60 per cent deduction of the eligible area.

| Banding | Partial ineligible percentage |

|---|---|

| Less than 1 per cent | 0.5 per cent |

| 1 - 3 per cent | 1 per cent |

| More than 3 - 10 per cent | 5 per cent |

| More than 10 - 30 per cent | 20 per cent |

| More than 30 - 50 per cent | 40 per cent |

| More than 50 - 70 per cent | 60 per cent |

| More than 70 - 90 per cent | 80 per cent |

| More than 90 per cent | 100 per cent |

Technical assessment bands

Technical assessment examples

The following sections work through practical examples of assessing parcels for ineligible cover and calculating the maximum eligible area.

Process of calculating the eligible area:

- confirm the parcel boundary is correct; this determines the gross area of the field

- assess how much area of the parcel is covered with 100 per cent ineligible features, such as roads, rivers and buildings

- deduct these areas from the gross area

- assess how much area of the parcel is covered with partially ineligible features, such as gorse, bracken and scrub

- assess what percentage of each of these partially ineligible features is actually ineligible

- deduct these areas from the area calculated at point three. This leaves you with the maximum net eligible area of the field

Example one

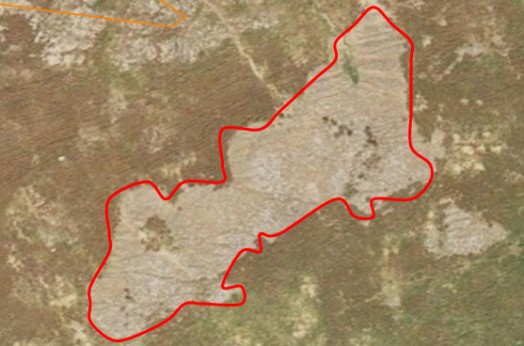

In this example the features are gorse and scrub (area in red), classified as GOR and SCB. The area of ineligibility is assessed in proportion to the size of the parcel.

The percentage of ineligibility is assessed for the area identified.

The gross area of the parcel = 3.60 hectares.

Assess parcel area of ineligible cover:

- less or equal to 100 per cent ? = less

- less or more or equal to 50 per cent - (1/2)? = more

- less or more or equal to 75 per cent - (3/4)? = equal

The area of gorse and scrub is 75 per cent of the parcel = 2.70 hectares.

Given that the ineligible area of gorse and scrub is 2.70 hectares we now need to assess what percentage is ineligible cover:

- less or more or equal to 50 per cent - (1/2)? = more

- less or more or equal to 75 per cent - (3/4)? = more

- less or equal to 100 per cent ? = equal

The whole area is deemed as being fully dense impenetrable vegetation with no grazing understory so the assessment equals 100 per cent exclusion.

The technical assessment bands are not applicable where ineligibility is assessed at 100 per cent. Hence the whole area of gorse (2.70 hectares) is ineligible.

Therefore the maximum eligible area = 3.60 hectares (gross field area) - 2.70 hectares (ineligible area) = 0.90 hectares.

Example two

In this example the feature is gorse (areas in red), classified as GOR. The area of ineligibility is assessed in proportion to the size of the parcel.

The percentage of ineligibility is assessed for the area identified.

The gross area of the parcel = 3.70 hectares.

Assess parcel area of ineligible cover:

- less or equal to 100 per cent ? = less

- less or more or equal to 50 per cent - (1/2)? = less

- less or more or equal to 25 per cent - (1/4)? = equal

The area of gorse is 25 per cent of the parcel = 0.93 hectares.

Given that the ineligible area of gorse is 0.93 hectares we now need to assess what percentage is ineligible cover:

- less or equal to 100 per cent ? = less

- less or more or equal to 50 per cent - (1/2)? = less

- less or more or equal to 25 per cent - (1/4) = more

The areas are deemed as being 40 per cent covered in dense impenetrable vegetation with no grazing understory.

Using the technical assessment bands 40 per cent falls into the more than 30 to 50 per cent band, and therefore becomes a 40 per cent exclusion.

Exclusion area = 0.93 hectares x 0.40 per cent = 0.37 hectares.

Therefore the maximum net eligible area = 3.70 hectares (gross field area) - 0.37 hectares (ineligible area) = 3.33 hectares.

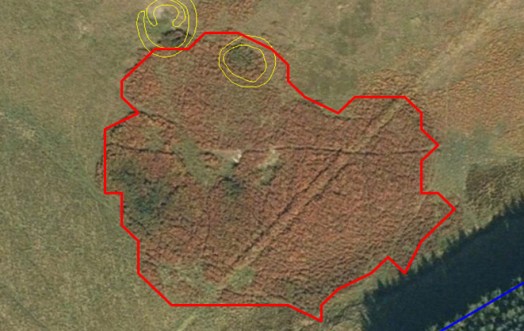

Example three

In this example the features are gorse and scrub (area in red), classified as GOR and SCB. The area of ineligibility is assessed in proportion to the size of the parcel.

The percentage of ineligibility is assessed for the area identified. The gross area of the parcel = 12.00 hectares.

Assess parcel area of ineligible cover:

- less or more or equal to 50 per cent - (1/2)? = less

- less or more or equal to 25 per cent - (1/4)? = less

- less or more or equal to 12.5 per cent - (1/8)? = less

- less or more or equal to 6.25 per cent - (1/16)? = equal

The area of gorse and scrub is 6.25 per cent of the parcel = 0.75 hectares.

Given that the ineligible area of gorse and scrub is 0.75 hectares we now need to assess what percentage is ineligible cover:

- less or equal to 100 per cent ? = less

- less or more or equal to 50 per cent - (1/2)? = more

- less or more or equal to 75 per cent - (3/4) = less

The areas are deemed as being 60 per cent covered in dense impenetrable vegetation with no grazing understory.

Using the technical assessment bands 60 per cent falls into the more than 50 to 70 per cent band, and therefore becomes a 60 per cent exclusion.

Exclusion area = 0.75 hectares x 0.60 per cent = 0.42 hectares.

Therefore the maximum net eligible area = 12.00 hectares (gross field area) – 0.42 hectares (ineligible area) = 11.55 hectares.

Technical assessment of an ineligible feature within a parcel

If you have more accurate ways to measure features, such as GPS equipment, the determination of the area to be technically assessed may be more accurate, but the principles of assessing the area thereafter are the same.

Land inspectors will either use GPS to plot areas or use MasterMap shapes (TOIDs – TOpographic IDentifier) as the basis of their assessment.

Each MasterMap TOID has a fixed area that can be used by an inspector for the technical assessment.

Technical assessment of a TOID

Example four

In this example the feature is scree (area in red), the area of ineligibility is defined by the TOID and a percentage ineligible can be determined.

Assess percentage ineligible:

- less or more than 50 per cent - (1/2)? = more

- less or more than 75 per cent - (3/4)? = more

- less or equal to 100 per cent? = less

In this example the scree preventing the growth of usable forage is estimated as being 80 per cent ineligible. Using the technical assessment bands 80 per cent falls into the more than 70 to 90 per cent band, and therefore becomes an 80 per cent exclusion.

Regardless of which feature is being assessed and the percentage of ineligibility, you must first determine the boundary of the feature.

This boundary gives you the maximum area that can be attributed to the exclusion.

Example five

In this example the feature is gorse, the area of ineligibility is defined by the TOID (orange line) and a percentage ineligible can be determined.

Assess percentage ineligible:

- less or more than 50 per cent - (1/2)? = more

- less or more than 75 per cent - (3/4)? = more

- less or equal to 100 per cent ? = less

In this example the dense impenetrable gorse, with no available grazing understory, is estimated as being 85 per cent ineligible.

Using the technical assessment bands 85 per cent falls into the more than 70 to 90 per cent band, and therefore becomes an 80 per cent exclusion.

Example six

In this example the feature is gorse, the area of ineligibility is defined by the TOID (orange line) and the parcel boundary and a percentage ineligible can be determined.

Assess percentage ineligible:

- less or more than 50 per cent - (1/2)? = less

- less or more than 25 per cent - (1/4)? = less

- less or more than 10 per cent - (1/10)? = less

- less or more than five per cent - (1/5)? = equal

In this example the dense impenetrable gorse, with no available grazing understory, is assessed as being five per cent ineligible.

Using the technical assessment bands five per cent falls into the more than three to 10 per cent band, and therefore becomes a five per cent exclusion.

Example seven

In this example below the feature is bracken the area of ineligibility is defined by the TOID (red line) and a percentage ineligible can be determined.

Assess percentage ineligible:

- less or more than 50 per cent - (1/2)? = less

- less or more than 25 per cent - (1/4)? = more

- less or more than 37.5 per cent? = more

In this example the dense impenetrable bracken, with no available grazing understory, is assessed as being 40 per cent ineligible.

Using the technical assessment bands 40 per cent falls into the more than 30 to 50 per cent band, and therefore becomes a 40 per cent exclusion.

Example eight

In this example the feature is trees, the area of ineligibility is defined by the TOID (red line) and a percentage ineligible can be determined.

Assess percentage ineligible:

- less or equal to 100 per cent? = equal

In this example the dense impenetrable trees, with no available grazing understory, is assessed as being 100 per cent ineligible.

The technical assessment bands are not applicable where ineligibility is assessed at 100 per cent.

Example nine

In this example the feature is trees. The area of ineligibility is defined by the parcel boundary, which is also a TOID, and a percentage ineligible can be determined.

Assess percentage ineligible:

- less or more than 50 per cent - (1/2)? = less

- less or more than 25 per cent - (1/4)? = less

- less or more than 10 per cent - (1/10)? = more

In this example the dense impenetrable trees, with no available grazing understory, was assessed as being 20 per cent ineligible as the remainder was assessed as open grazed woodland.

Using the technical assessment bands, 20 per cent falls into the more than 10 to 30 per cent band, and therefore becomes a 20 per cent exclusion.

Recent changes

| Section | Change |

|---|---|

| Land used for woodland creation | Guidance updated |

Previous versions

Download guidance

Click 'Download this page' to create a printable version of this guidance you can save or print out.