Croft House Grant full guidance

This is an old version of the page

The Croft House Grant is replacing the Croft House Grant Scheme and takes effect from 1 April, 2016.

To see the old scheme guidance, visit the archive section.

This is an old version of this page

Date published: 1 April, 2016

Date superseded: 25 August, 2016

To see recent changes to this guidance, check the bottom of the page.

Table of Contents

- Introduction

- Level of grant

- Who is eligible

- Who is ineligible

- Other reasons for rejection

- Grant conditions

- Planning consent and building warrant

- New house

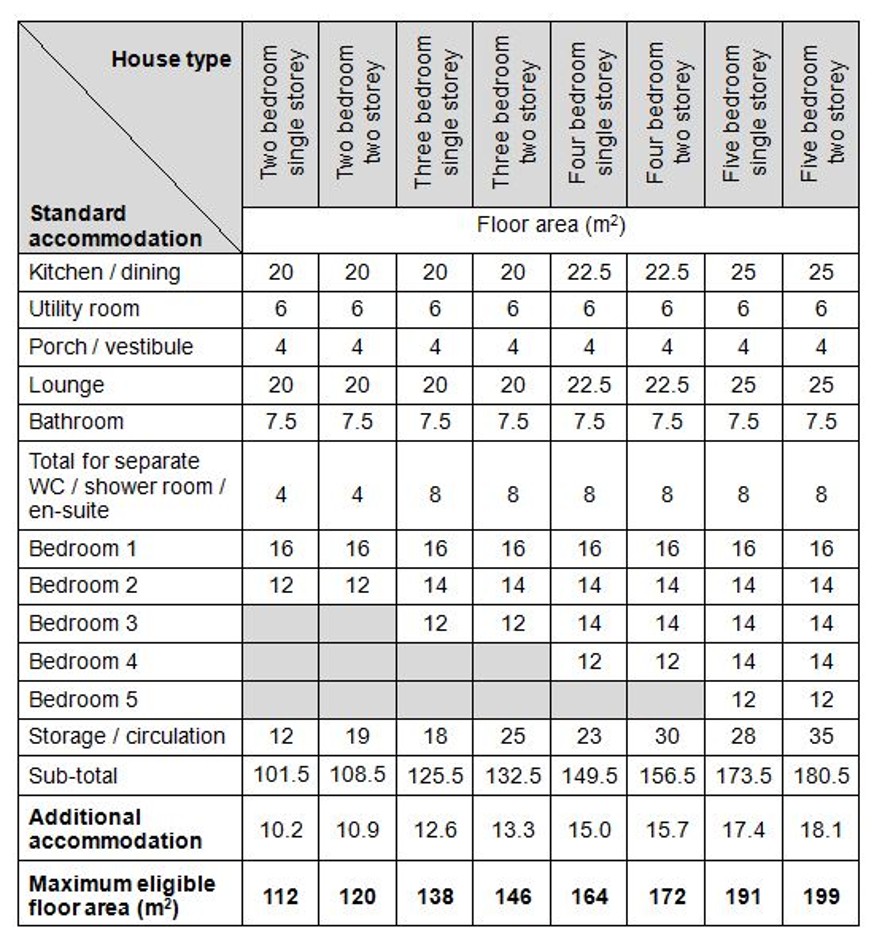

- Table A

- House improvements

- How to apply

- Selection criteria

- Approval and contract

- Claims and payments procedure

- Verification and control

- Legal base

- Data disclosure

- Refusals

- Privacy notice

- Complaints

- Contact us

- Annex A

- Annex B

- Annex C

- Annex D

- Annex E

- Recent changes

- Previous versions

- Download

Introduction

Crofting tenure requires crofters to live within 32 kilometres of their croft and provide their own housing – where there is not already adequate housing on the croft.

Due to the nature of crofting as a form of land tenure, and the predominance of self-build as a means to provide housing, it can be challenging for crofters to access conventional forms of housing finance.

Also, crofting areas are often located in the most remote areas of the Highlands and Islands of Scotland. This remoteness, together with the challenges of terrain, climate and lack of access to utility services, leads to increased house building and improvement costs.

This Scottish Government-funded arrangement is designed to ease some of this burden and provide grants for crofters to improve and maintain the standards of crofter housing. In doing so it attracts and retains people within the crofting areas of Scotland and helps sustains crofting as a traditional means of land tenure.

Before you apply for this grant, please read this guidance in full.

Level of grant

The tables below show the rates of assistance available for the construction of a new house and the rebuilding and improvement of an existing house.

| New house grant | Geographical area | |

| High priority | Standard priority | |

| £38,000 | £28,000 | |

| Rebuilding and improvement | Geographical area | |

| High priority | Standard priority | |

|

40% of costs up to a maximum grant of £38,000 |

40% of costs up to a maximum grant of £28,000 | |

We will confirm the amount of grant applicable to the location of your croft when we acknowledge receipt of your completed application form. Please note that areas of priority will be reviewed on a regular basis (at least every three years).

A map setting out current priority areas is included in Annex A.

We will confirm the amount of grant applicable to your croft’s location when we acknowledge receipt of your completed application form. Areas of priority may change.

Payments will be made in three instalments and you should not commit to starting any work until your application has been approved.

Who is eligible

The Croft House Grant (CHG) is open to:

- a tenant crofter

- an owner-occupier crofter

- a cottar (in the case of cottar applicants, references to “croft” and “crofter” in this guidance should be read as references to cottars and holdings occupied by cottars)

All of the above are defined in the Crofters (Scotland) Act 1993 (as amended), and includes Kyles Crofters.

To be eligible for grant assistance, you must be ‘inadequately housed’.

This is defined as (only one need apply):

- your present accommodation does not provide sufficient accommodation for you and your immediate family

- your present accommodation does not meet an adequate standard

- you currently live with parents, are at least 21 years old and can show you have worked the croft for at least two years

Alternatively you must be in need of a house on the croft because (only one need apply):

- the type of agricultural activities or non-agricultural activities undertaken or proposed require you to live on the croft

- you currently live in rented accommodation (including council housing)

- the assisted house must become your only or principal home and you must intend to work the croft

Who is ineligible

You are not eligible for assistance if you:

- are the landlord of the croft or spouse / partner of the landlord

- are the landlord of a vacant croft

- are adequately housed within working distance of the croft, unless there are special agricultural or business justifications which require you to live on the croft

- you do not intend to work the croft or do not provide proposals that commit you to working the croft within a reasonable timeframe

- you will receive or have already received a grant from another public source for the same work. If you have already received, or applied for, grant aid from any other public source to support your proposal, you should consult the RPID Tiree office to make sure there are no double funding issues

Other reasons for rejection

Assistance under CHG will also be refused if any of these conditions occur:

- you gave up ownership of an adequate house on the croft within the last five years

- the proposed work is not eligible work (see the sections below on eligible work)

- croft house grant assistance was provided in the last 10 years

- the cost of the project is less than £8,000 (inclusive of VAT)

- you have already started the work before CHG funding is approved

- you already have a house on the croft. Please note that there may be certain circumstances where we would allow this

Grant conditions

Conditions apply to the grant for a period of 10 years (or until the outstanding proportion of the grant is repaid if earlier than this period).

The following grant conditions will be registered in the Land Register or recorded in the Register of Sasines in the Notice of Grant Conditions:

- the house must be occupied by you or your immediate family as an only or principal home. If you stop occupying the house, it must be occupied by another crofter, owner-occupier crofter or cottar or their immediate family

- the building must be maintained in a good state of repair

- the building must be insured against destruction or damage

- any proposed sale or lease of the house or croft, or any renunciation, assignation or sub-lease of the tenancy of the house or croft, must be notified to us in writing with the name and address of any proposed new tenant or owner. Our consent to this proposed transfer must be obtained before it takes place

Breach of any of these conditions within the grant period may result in a demand for repayment of the outstanding proportion of the grant with interest on that proportion of grant from the date on which payment of grant was made. The interest rate applied will be eight per cent above the Bank of England base rate, calculated on a daily basis.

The person liable for the repayment is the crofter at the time of the breach of condition (or cottar in the case of a house related to a cottar’s holding), or other person to whom the interest in the house has been transferred or assigned, except in the circumstances below, where the following person is liable:

- where the house becomes vacant on death, the deceased’s executor

- where there is no crofter at the time of the breach of condition because the lease of the croft has been terminated and the house has become un-let, the person who was last the tenant of the croft

The following further grant conditions also apply and will be set out in the grant contract you enter into with us:

- you must exhibit to us on demand the receipts for the premiums in respect of the renewals of insurance of the house that is required against destruction and damage

- in the event of your death during the grant period, your executor must notify us of the date of your death and the name and address of any proposed new tenant or owner

- you must allow any person authorised by us to enter and inspect the house to check whether the conditions are being complied with and you must, if requested, provide us with a certificate stating that the conditions are being complied with

If you breach any of these conditions this will amount to a default under the contract you have entered into with us for the grant. If you commit this or any other default under the contract, you may have to repay a proportion of the grant. You should refer to the grant contract for further detail.

It is an offence to knowingly or recklessly make a false statement for the purpose of obtaining a grant under CHG. Also, if you knowingly provide inaccurate information or make an inaccurate statement that will amount to a default under the grant contract, you may be required to repay all the grant assistance provided.

You must also have a business plan for the croft which you agree with us and you must adhere to that plan.

A fee is payable for the preparation of legal documents. This will be deducted from the total amount of grant for the preparation and recording of the Notice of Payment of Grant document.

Planning consent and building warrant

Applicants will be responsible for obtaining the local authority planning consent and building warrant.

It is not necessary to submit planning consent and building warrant with the application for CHG funding. However, where required, these must be in place before CHG-funded improvements begin.

Copies of these documents will be retained by the RPID Tiree office. Where planning consent and / or a building warrant is not required, applicants shall submit local authority waiver letters with their first claim for payment.

Where appropriate, applicants shall submit building warrant completion certificates with their final claim for payment.

New house

- New houses – general

New croft houses may be:

- a traditionally constructed house

- a timber-framed house

Other suitable types will be given individual consideration on a case-by-case basis.

New houses must be dwelling houses which are fully compliant with the Scottish Building Standards, available at the following Scottish Government website.

New houses – location

An eligible croft house can be built on land adjoining or adjacent to the croft or on an apportionment associated with that croft provided the applicant can demonstrate that this would be a more feasible option than building on the croft and, in particular, if that meant that a house would not be built on better quality in-bye land.

New houses – size

There are limits on the internal floor areas of new houses funded by CHG.

The maximum eligible floor areas for various new house types are given in Table A.

Maximum eligible floor areas are sum of:

- typical areas for standard accommodation

- a storage and circulation space allowance

- a 10 per cent allowance for additional accommodation

but excludes the following:

- areas where head height is less than 1.8m,

- areas occupied by doors and partitions,

- areas occupied by fixed hearths and chimney breasts,

- small areas between the line of external wall linings and doors or windows extending down to floor level,

- un-developed loft space (provided the whole loft is undeveloped),

- integral Garages (garages with internal areas no more than 20m²). Houses with an integral garage with internal area more than 20m² will not be eligible.

- voids (areas in a two storey house with no first floor) in the first floor at stairwells and landings (subject to a maximum of 4m²). Any area greater than 4m² will be included in the floor area calculation,

- external areas covered beneath the roof line (subject to a maximum of 4m²). Again any area greater than 4m² will be included in the floor area calculation.

The following rooms would be considered to be standard accommodation:

- 1 kitchen / dining room

- 1 utility room

- 1 porch/vestibule

- 1 lounge

- 1 bathroom

- separate WC / shower room / en-suite (no more than two of these)

- bedrooms (between two and five, depending on the needs of your household).

Separate dining rooms, family rooms and a study / office would be considered additional accommodation. However, new houses with other room configurations may still be eligible for CHG funding, provided the overall floor area does not exceed the maximum eligible floor areas given in Table A.

Applicants will be required to submit plans showing proposed floor layouts and room sizes with their application for CHG funding. Plans must provide sufficient detail for a floor area calculation by RPID.

Detached garages are not eligible for CHG funding.

CHG funded houses must not exceed the floor area given in the grant approval, unless prior approval has been given by the RPID Tiree office. Unapproved increases in floor area may render the house ineligible for CHG funding.

Table A

New houses – number of apartments

Minimum number of rooms other than kitchens, utility rooms, bathrooms and WCs:

Eligible croft houses should normally have at least four apartments (three bedrooms and one living area) in addition to the kitchen and bathroom. However we would be happy to consider a smaller house depending on an individual’s circumstances

New houses – facilities

Kitchen, utility rooms bathrooms and WCs:

Generally, the facilities which are eligible are those required to comply with Building Standard 3.11 - Facilities in Dwellings and 3.12 – Sanitary Facilities, subject to the floor area limits given in Table A.

New houses – ineligible work

Ineligible works include, but are not limited to:

- sun rooms and conservatories

- large patios and decked areas

- detached garages

- mobile homes

- temporary structures

- second or holiday homes

House improvements

Eligible work – general

Eligible work will bring a house up to an acceptable standard for habitation, and provide satisfactory accommodation for the resident crofter and his or her family.

As a general principle, the works which are eligible are those required to improve an existing building to provide a functional dwelling house, or part of a dwelling, which complies with the Scottish Building Standards. These are available at the Scottish Government website.

Specific references to the building standards are given in italics.

On completion of improvement works funded by CHG, a house should be safe and in a good state of repair generally. Therefore, it may be necessary to include ad-hoc repairs and improvements in the approved works (e.g. repair or replacement of broken rhones and downpipes, provision of smoke alarms).

Where appropriate, these ad-hoc repairs and improvements will be identified by the RPID buildings officer, and shall be carried out at the applicant’s own expense.

Improvement of houses or parts of houses which have become dilapidated due to neglect or lack of maintenance are not eligible for CHG funding, except in cases where the croft tenancy, or owner in the case of owner-occupier crofts, has changed, or the crofter's interest in the house has been assigned or transferred to someone else, and the dilapidated house has new occupants.

Eligible work is further defined in the minor and major improvements sections.

Works to improve energy efficiency

The Scottish Government recognises the importance of works to improve the energy efficiency of houses, and it is expected that these measures shall be included in new houses and major improvements, in accordance with the Building Standard 6.0 - Energy.

However, other sources of funding are available to support works solely intended to improve the energy efficiency of houses, and therefore this type of work is not eligible for CHG funding.

Applicants intending to carry out this type of work should refer to the Energy Saving Trust website.

Structural integrity of the original building

RPID buildings officers shall not be responsible for assessing the structural integrity of houses to be improved. In cases where there are any concerns, the applicant may be required to provide a structural engineer’s report, which confirms that the original building is suitable for the proposed improvement work.

Competitive quotations

Applicants shall obtain at least two competitive quotations for proposed improvement work. These shall be submitted with the application for CHG funding.

Quotations shall be "like for like", and where appropriate based on specifications prepared by a suitably qualified building professional.

Minimum value

The minimum value of CHG funded improvement works (including the crofter’s and CHG contribution) is £8,000 including VAT.

Applications for CHG funding for works valued at less than £8,000 including VAT will be rejected.

Major improvements

Major improvements may include:

- works to bring existing houses which are below a tolerable standard to an acceptable condition for habitation

- works to extend houses which are in good condition, but too small for the crofter and his or her family

Major improvements may also convert other buildings not currently used as houses.

Major improvements – size

The usual maximum eligible floor area of improved houses will be as per Table A. RPID may exercise some flexibility in cases where proposed floor areas exceed the floor area limits, due to the layout of the original building.

Maximum eligible floor areas are sum of:

- typical areas for standard accommodation

- a storage and circulation space allowance

- a 10 per cent allowance for additional accommodation

but excludes the following:

- areas where head height is less than 1.8m, mmm

- areas occupied by doors and partitions,

- areas occupied by fixed hearths and chimney breasts,

- small areas between the line of external wall linings and doors or windows extending down to floor level,

- un-developed loft space (provided the whole loft is undeveloped),

- integral Garages (garages with internal areas no more than 20m²). Houses with an integral garage with internal area more than 20m² will not be eligible.

- voids (areas in a two storey house with no first floor) in the first floor at stairwells and landings (subject to a maximum of 4m²). Any area greater than 4m² will be included in the floor area calculation,

- external areas covered beneath the roof line (subject to a maximum of 4m²). Again any area greater than 4m² will be included in the floor area calculation.

The following rooms would be considered to be standard accommodation:

- 1 kitchen / dining room

- 1 utility room

- 1 porch/vestibule

- 1 lounge

- 1 bathroom

- separate WC / shower room / en-suite (no more than two of these)

- bedrooms (between two and five, depending on the needs of your household).

Separate dining rooms, family rooms and a study / office would be considered additional accommodation. However, improved houses with other room configurations may still be eligible for CHG funding, provided the overall floor area does not exceed the maximum eligible floor areas given in Table A.

Applicants will be required to submit plans showing proposed floor layouts and room sizes with their application for CHG funding. Plans must provide sufficient detail for a floor area calculation by RPID.

Detached garages are not eligible for CHG funding.

CHG funded houses must not exceed the floor area given in the grant approval, unless prior approval has been given by the RPID Tiree office. Unapproved

increases in floor area may render the house ineligible for CHG funding.

Major improvements – number of apartments

Rooms other than kitchens, utility rooms, bathrooms and WCs:

Following CHG funded major improvements, houses should normally have at least four apartments (three bedrooms and one living area) in addition to the kitchen and bathroom. However we would be happy to consider a smaller house depending on an individual’s circumstances.

Major improvements – facilities (kitchen, utility rooms bathrooms and WCs)

In cases which involve complete refurbishment of the original building, eligible facilities are those required to comply with Building Standard 3.11 - Facilities in Dwellings and 3.12 – Sanitary Facilities, subject to the floor area limits given in Table A.

In cases where existing facilities need not be affected by the improvement works, (e.g. where there are adequate kitchen and bathroom in a house to be extended) the eligibility of new facilities will be judged on a case by case basis by the RPID buildings officer.

New facilities which are eligible are those which will provide an improved house with facilities commensurate with a new house of similar size, subject to total floor area limits given in Table A.

Larger more accessible facilities may be eligible in special circumstances. These will be judged on a case by case basis by the RPID Tiree office. Provision of modern fitted kitchens and bathrooms are eligible in cases which involve complete refurbishment of the original building.

Replacement of existing fitted kitchens and bathroom suites is not eligible.

Major improvements – eligible works

All cases will be assessed by a Scottish Government RPID Buildings Officer, and will be inspected to determine the eligibility of the proposed improvement work.

Improvements to the original building may include, but are not limited to:

- replacement of roof covering

- replacement of gutters and down pipes

- provision of, or modification and repairs to chimneys and flues

- repairs to cracks in walls (providing the movement has ceased, and the cracks are historic – in these cases a structural engineer’s report may be required)

- provision of chemical damp proof courses (DPCs)

- provision of, or replacement of external rendering, where this is required to maintain water tightness

- replacement of decayed or undersized structural elements such as lintels

- repairs to timber roof and floor structure where water ingress or infestation has led to decay

- provision of, or modification to external walls, and internal partitions as required to create a functional dwelling house

- provision of thermal and sound insulation to external wall linings, internal partitions, floors, and roof spaces

- provision of, or replacement of floors, solums and under-floor ventilation

- lowering external ground levels and provision of external drainage where required to divert surface water from the building

- provision of ramps and other means of access

- replacement of doors and windows

- application of chemical treatment of woodworm and other infestation

Replacement of specific building elements will be eligible where these have reached the end of their useful life (e.g. a roof covering which cannot be economically repaired), or are no longer fit for purpose (e.g. a first floor structure which is undersized, when assessed under current codes of practice for structural design).

Eligible works to extensions are those required to comply with the Scottish Building Standards, subject to the floor area limits given in Table A. Decorative work is eligible only when it is clearly incidental to CHG funded works, (e.g. first time painting of new walls ceilings and partitions, or plastering and repainting in an existing hallway at the opening to a new bathroom).

Major improvements - central heating, hot water and utility connections

Central heating and hot water systems are eligible for CHG funding where this is an integral part of major improvement work.

Eligibility under CHG extends to conventional central heating boilers and wet heating systems. Stoves which are connected to the wet heating systems are also eligible. Other funding schemes are available for renewable heat sources, and therefore these types of appliance are not eligible for CHG funding.

Applicants intending to install these types of appliance should refer to the Energy Saving Trust website.

In these cases, it is only the heat source which is ineligible; the wet heating systems (radiators and pipework) remain eligible.

Works to connect houses to the water supply, public sewerage, and other public utilities are eligible for CHG funding.

Major improvements – ineligible works

Generally, works to provide rooms or facilities not considered essential in a croft house, or items which are of a higher standard than deemed necessary in a croft house are not eligible for funding under CHG.

These ineligible works include, but are not limited to:

- sun rooms and conservatories

- large patios and decked areas

- detached garages

Replacement of limited life and consumable items such as fitted kitchens, bathroom suites, carpets and white goods are not eligible for CHG funding.

Minor improvements

Minor improvements are generally lower value works to upgrade one or more specific part of an existing house which is, or until recently has been occupied.

Minor improvements – eligible works

Generally, eligible minor improvement works are those required to maintain the weather tight building envelope, or provide the other minor improvements listed below:

- first time provision of modern fitted kitchens (not replacement)

- first time provision of bathrooms, or replacement of new bathroom suites (where the existing facilities have been judged to be below tolerable standard, by the RPID buildings officer)

- first time provision of storm porches with floor area not exceeding four square metres

- first time provision of a central heating system, or replacement of elements of the system which have come unsafe or un-serviceable (where supported by a report by a competent person)

- rewiring where the existing wiring has become unsafe or un-serviceable (where supported by a report by a competent person)

- replacement of a roof covering and roof drainage which has reached the end of its useful life and cannot be economically repaired

- replacement of external doors and windows which have reached the end of their useful life and cannot be economically repaired

Minor improvements – special circumstances

Minor improvements may also include works to provide improved access and other facilities required where there are older occupants, or those with special requirements, including:

- provision of external access ramps

- provision of accessible bathroom fittings

In these cases, where applications to other potential funding sources have been unsuccessful, eligibility will be judged on a case by case basis by the RPID Tiree office.

How to apply

Before sending in an application form you need a business registration number (BRN). You must register with RPID to get a BRN.

You can download an application form here:

PF20/a - Croft House Grant application form: new house

PF20/b - Croft House Grant application form: house improvements

Paper copies are available from any of our area offices.

If you need further help on completing our forms, contact the CHG team at:

The Business Centre

Crossapol

Isle of Tiree

PA77 6UP

Tel: 01879 220240

Email: CHGS@gov.scot

For new houses you will need to provide an estimated build cost on the application. We do not require contractor’s estimates with applications for new houses.

Applications for house improvements will require estimated costs to be provided on the application. This should be supported by at least two competitive quotations for the work, and three competitive quotations where one had been provided by a contractor connected to the applicant.

All necessary documentation (see selection criteria below) should be included with the application form, if any documentation is missing this may delay the processing of your application and any approval that may be given.

You are entitled to prepare plans and obtain planning permission and consents in advance of a CHG application.

Providing the application form is complete, we will acknowledge receipt of the form, confirm the amount of grant appropriate to the location of your croft, and start processing the application for inclusion in the next quarterly assessment tranche.

Assessment of applications will usually take place in a three monthly cycle.

| CHG opens | 1 April, 2016 |

| First tranche closing date | 1 May, 2016 |

| Second tranche closing date | 1 August, 2016 |

| Third tranche closing date | 1 November, 2016 |

| Fourth tranche closing date | 1 February, 2017 |

Selection criteria

The funds available for CHG are limited and it may not be possible to approve all eligible applications (the scoring criteria are detailed in Annex B).

If this is the case, other factors that we will consider to prioritise applications are:

- your current accommodation

- when you occupied the croft and what work you have done on the croft since you took occupation

- your combined household income

- any property on or off the croft that could be or has been

sold to fund a new build - your current and proposed activity on the croft

In order to allow us to assess you in relation to the above criteria we will require you to provide originals or certified copies by a third party of the following:

- proof of address (a bank statement or utility bill dated within the last four months or a full driving licence)

- current fixed assets or assets sold within last five years. Provide evidence of any outstanding mortgage settlements

- evidence of value of asset must be confirmed in writing by a suitably qualified surveyor if the application is successful

- proof of income from employment - (P60s for the last three years for you (and your partner, if they will also be resident in the croft house). If you (or your partner) have been in your current role for less than one year, please provide written confirmation of you salary from your employer)

- other income – (for example pension statements for the last three years (or since you retired if less than three years ago) or annual HMRC tax returns for the last three years if you are self-employed)

- we may also request additional information to verify your fixed assets or income

- date of assignation (letter from the Crofting Commission confirming date of croft assignation)

- a business plan for the croft (this may be for agricultural or other purposeful use of the croft)

- a plan of your new build or improvement proposal which includes floor areas and room sizes for new builds and major improvements

Approval and contract

If your application is approved you will be notified and an offer of contract will be sent to you which you must sign and return to us if you wish to accept the offer with the conditions set out in the contract.

The contract will state the amount of grant available to you. The conditions of this contract apply for a period of 10 years for all projects.

You should not commit to starting any work until your application has been approved.

The landlord of the croft will also be notified that an offer of grant for the proposed work has been made.

Claims and payments procedure

Claims for new builds, rebuilds and house improvement can be paid in up to three instalments, at stages set out in the CHG grant offer letter. Conditions relating to payment and amounts of these instalments will vary between projects and will be confirmed in the CHG grant offer letter.

New houses are exempt from VAT. Therefore claims / payments will not include VAT.

Claims – new houses

We will make payments for the construction of new homes as work progresses. You will be required to submit a claim after each of the three payment stages, countersigned by an independent responsible person.

The maximum build time for new houses is 36 months and it is expected that a new house would reach the wind and water tight stage within 18 months. You should contact the RPID Tiree office should you not be able to meet these timescales.

This section describes the stage at which claims can be made and the supporting documentation required.

We require receipted invoices at certain stages to confirm:

- the amount paid

- the date and method of payment

- confirm that the cost have been incurred by the applicant / claimant

The value of claims will be as set out in the CHG grant offer letter.

The value of claims is not the actual costs incurred. However we require evidence that costs incurred by the applicant /claimant are no less than the amount of grant paid.

First claim

The first claim to the value stated in the CHG grant offer letter may be submitted when the new house is wind and watertight.

Alternatively, where the new house will have a timber frame kit, the first claim may be submitted when the kit is paid for and delivered to site. In this case the claim must be accompanied by a receipted invoice from the timber frame kit supplier and a delivery note confirming its arrival on site.

We would require the following supporting documentation:

- planning permission and one copy of each of the stamped drawings

- building warrant and one copy of each of the stamped drawings

- where appropriate, evidence of compliance with any additional conditions set out in the CHG grant offer letter

- where appropriate, a receipted invoice and delivery note from supplier of the timber frame kit.

Requirements for receipted invoices are given in Annex C.

Second claim

The second claim will be submitted at the stage, and to the value stated in the CHG grant offer letter. We would not normally require any supporting documentation with the second claim unless specified in the grant offer letter.

Third and final claim

The final claim to the value stated in the CHG grant offer letter may be submitted on completion of the new house and when the applicant / claimant is resident in the new house.

We would require the following supporting documentation:

- building warrant completion certificate

- receipted contractor’s invoices confirming costs incurred by the applicant/claimant up to the amount of grant to be paid

CHG payments of the amounts set out below will be made as work progresses.

| Stages |

Geographical area |

|

|

| High priority |

Standard priority |

| Kit paid for and delivered to site or wind and watertight stage. | £18,000 | £13,000 |

| Interior complete | £10,000 | £7500 |

| Completion certificate obtained | £10,000 | £7500 |

Claims – house improvements

We will make payments for house improvements as work progresses. You will be required to submit a claim after each of the three payment stages, countersigned by an independent responsible person.

The maximum time for house improvements will be stated in the CHG grant approval letter. You should contact the CHG office should you not be able to meet these timescales.

This section describes the stage at which claims can be made and the supporting documentation required.

We require receipted invoices at certain stages to confirm:

- the amount paid

- the date and method of payment

- confirm that the cost have been incurred by the applicant / claimant

The value of claims will be as set out in the CHG grant offer letter. The value of claims are based on the estimates of actual costs submitted as part of your grant application.

If actual costs change then you should inform the RPID Tiree office. There is no guarantee that additional costs can be funded.

However, where costs have reduced, grant levels will also be reduced accordingly.

First claim

The first claim may be submitted at the stage, and to the value stated in the CHG grant offer letter.

We require the following supporting documentation:

- planning permission and one copy of each of the stamped drawings, or a waiver letter from the local authority confirming that planning permission is not required

- building warrant and one copy of each of the stamped drawings, or a waiver letter from the local authority confirming that a building warrant is not required

- where appropriate, evidence of compliance with any additional conditions set out in the CHG grant offer letter

Requirements for receipted invoices are given in Annex C.

Second claim

The second claim will be submitted at the stage, and to the value stated in the CHG grant offer letter. We would not normally require any supporting documentation with the second claim unless specified in the grant offer letter.

Third and final claim

The final claim to the value stated in the CHG grant offer letter will be submitted when the house improvement work is completed and when the applicant / claimant is resident in the improved house.

We require the following supporting documentation:

- where appropriate, a building warrant completion certificate

- all remaining receipted contractor’s invoices confirming costs incurred by the applicant/claimant detailing up to the full cost of the project

A fee is also payable to cover Register of Scotland charges. This will be deducted from the total amount of grant for the preparation and recording of the Notice of Conditions of Grant. This amount may vary as per Registers of Scotland charges.

Payment claims should be submitted to your local area office.

Verification and control

You may be asked to provide evidence of progress with your agreed croft business plans during the period covered by the grant conditions which may include a visit to your croft.

Your claims will also be subject to our inspections procedures. This means that you may be visited to confirm the expenditure made.

If you have applied for a rebuilding and improvement grant, or where you advise your existing accommodation is inadequate, we will arrange to inspect your existing property before making a decision on your application.

Legal base

This guidance accompanies the Croft House Grant (Scotland) Regulations 2016 which have applied since 1 April 2016.

The Scottish Ministers made these Regulations using the powers conferred by section 42(6) of the Crofters (Scotland) Act 1993 (as read with sections 42(4), 44 and 45(1)(ca) of that Act) and all other powers enabling them to do so.

Applications made on or after 1 April, 2016 will be governed by these Regulations and this guidance.

These Regulations replace the Croft House Grant (Scotland) Regulations 2006. However, applications made and grants awarded under the 2006 Regulations will continue to be governed by those Regulations and the guidance that accompanied them.

Data disclosure

We have a legal duty to keep the conditions of:

- the Data Protection Act 1998

- the Freedom of Information (Scotland) Act 2002 (FOISA)

- the Environmental Information (Scotland) Regulations 2004 (EIR)

It is the policy of Scottish Ministers to share relevant data, including historical data, that is held on your business with other organisations for legitimate purposes and when required to do so and also to share relevant data on FOISA and EIR when it is in the public interest.

It is also the policy of Ministers to release headline information on grants provided under CHG. We will protect personal data we receive in line with the Data Protection Act 1998.

We will use the data you have provided primarily for the purpose of processing this application. Data may also be used for statistical purposes, not identifying individuals, which may reduce the need for some statistical data collection.

It may also be used when necessary to comply with the Freedom of Information Act or the Environmental Information Regulations noted previously.

Refusals

If you wish to have an explanation of how the decision to refuse your application was made, you should put your request in writing and address it to:

Head of CHG Branch

Croft House Grant

The Business Centre

Crossapol

Isle of Tiree PA77 6UP

Email: CHGS@gov.scot

Privacy notice

Details of how we use the information you give us.

Complaints

If you want to make a complaint, you must follow the Scottish Government procedure outlined here.

Contact us

If you need to talk to one of our area office staff, you can find details of your nearest RPID office here.

Annex A

Annex B

Annex C

Annex D

Annex E

Recent changes

| Section | Change | Previous text | New text |

|---|---|---|---|

| Grant rates | Title of section changed | Grant rates |

Grant conditions |

| Grant conditions | Text removed |

'Claims will normally be processed within 90 days of receipt' | |

| Selection criteria | Text removed |

'Proposed energy efficient improvements' 'An explanation of any energy efficient measures included in your proposal' | |

| New house - size | More details on what is considered acceptable size | ||

| Major improvements - size | More details on what is considered acceptable size | ||

| Energy efficiency | Section removed | ||

| Annex B and C | Energy efficiency removed |

Previous versions

Download

Click 'Download this page' to create a printer-friendly version of this guidance that you can save or print out.