Farmers reminded to be vigilant against fraud

Farmers across Scotland are advised to be alert to on-going banking scams in which fraudsters may target the farming community.

Our Scottish Government Rural Payments and Inspections Division (RPID) area offices will never cold call you and ask for personal information and, when you call us, our teams will ask you to verify your identity before discussing anything related to your business.

However, as historic payments under the CAP are published online, it may be possible for scammers to work out what businesses have received payments this year and approximately how much.

Attempts to gain access to personal and banking information could be made in different ways. For example, a business may be sent an official-looking letter or email asking them to reply with certain details that could then be used to steal money.

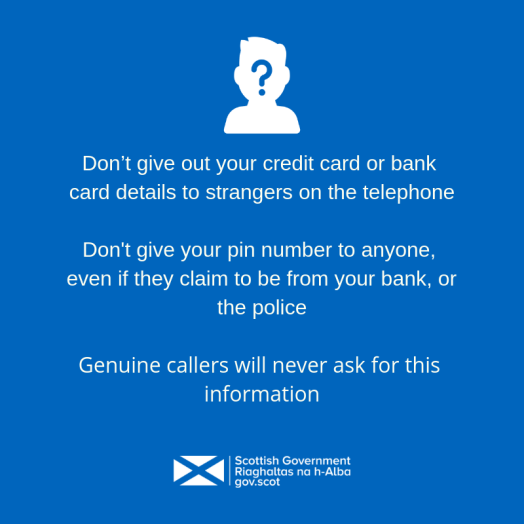

Another tactic could be a phone call supposedly from the Scottish Government or your bank asking for personal details.

Typically, these attempts to steal your information are presented as some sort of effort to resolve a problem with your account.

If you are unsure of any correspondence or requests you receive, please take immediate steps to verify that they are genuine.

If you are contacted by post or email, please call your local area office immediately.

Phone scammers will frequently ask their victims to make a call to their bank – or even the Scottish Government - to verify they are who they say they are but will then keep the line open and intercept the call.

So if you receive a call that you are unsure of or the caller requests you call the Scottish Government, call your area office from a different phone line.

You can check a number that has called you by searching for it on the internet.

And remember - you should only ever contact your area office using the details in the contact section of Rural Payment and Services.

You can get more advice on cyber security on the Scottish Government website.

Published on: 3 October, 2019