Preparing for Sustainable Farming full guidance

Date published: 11 June, 2025

For recent changes to this guidance, please see the bottom of the page.

Table of Contents

- Introduction

- Who can claim

- Organisations that may provide additional information

- Carbon Audits

- Soil Sampling

- Animal Health and Welfare Interventions

- Claim process

- Verification

- Payment

- Contract terms and conditions

- Additional Information

- Appendix A: Personal Development links

- Appendix B: Glossary

- Previous versions

Make your carbon audit, soil analysis or animal health and welfare claims

Start your applicationIntroduction

The Cabinet Secretary announced in October 2021 that a National Test Programme was to be developed to support farmers and crofters to play their part in Scotland becoming a global leader in sustainable and regenerative agriculture.

The Programme will support and encourage farmers and crofters to learn about how their work impacts on climate and nature. The Agriculture Reform Implementation Oversight Board (ARIOB) was established with several stakeholders from across the Scottish Agricultural and wider rural economy, and the Policy Development Group (PDG), which includes external members, was set up to provide advice to Scottish Government officials to direct the National Test Programme scheme going forward.

Preparing for Sustainable Farming (PSF), the first part of this Programme, went live in spring 2022 and helps ensure that when the new rural support regime was introduced, enhanced conditionality is integrated with all Basic Payment Scheme funding for farming and crofting for 2025 providing actions for biodiversity gain and low emissions production.

Conditionality means that in the future, Climate mitigation and how Biodiversity is looked after and encouraged by businesses, will be a condition business have to meet to receive agricultural support payments.

Preparing for Sustainable Farming (PSF) focuses on incentives to farmers and crofters to help them understand their Carbon emissions and sequestration, identifying recommendations that can lower these emissions and increase efficiencies.

It is recognised that there is a population already engaged with climate mitigation but we need to widen the opportunity and engagement with the industry if we are going to reduce its emissions in line with the Climate Change Plan.

There are three options currently being funded as part of Preparing for Sustainable Farming (PSF) that Scottish farmers, crofters, and agricultural contractors can claim funding for.

These three options are:

- Carbon Audits

- Soil Sampling and Analysis

- Animal Health and Welfare Interventions

Additionally linked to Preparing for Sustainable Farming we are providing Suckler beef producers access to MyHerdStats. This is a new online tool that securely presents herd management information within the ScotEID system utilising your existing login details.

MyHerdStats, developed by ScotEID, is a software tool that utilizes statutory cattle traceability data to provide cattle keepers with a consistent and accurate insight into their herd performance to help highlight opportunities to improve business and environmental benefits.

Cattle keepers can gain access to a selection of herd performance indicators and trends, for example:

- Cows retained percentage,

- Calves registered,

- Cows calved,

- Values of cow and heifer efficiency,

- Cow and calf mortalities,

- Sale date profile for breeding and youngstock.

Over time MyHerdStats will be developed to incorporate additional functionality. MyHerdStats is now available to every cattle keeper in Scotland by signing into their ScotEID account using their username and password.

Once the keeper has logged in, click on the tab ‘MyHerdStats’ which can be found under Cattle – ScotMoves+ - Open MyHerdStats, within the drop-down list on the left-hand side of the screen.

Legal Basis

The National Test Programme is operated under the Environmental Protection Act 1990 (the 1990 Act).

This provides the Scottish Ministers with a wide range of grant making powers in the field of environmental protection and includes the power to give financial assistance supported by Scottish Statutory Instruments 2022 No. 8.

The National Test Programme has been classified as a Green box measure under the World Trade Organisation (WTO) Agreement on Agriculture (AoA).

Who can claim

Scottish farmers, crofters and agricultural contractors (based in Scotland), can claim for this grant if they:

- are registered for funding with Scottish Government Rural Payments and Inspections Division (SGRPID)

- have a Rural Payments and Services (RPS) username and password

- are registered sheep and/or cattle keepers when claiming for Animal Health and Welfare interventions.

Farmers, crofters and agricultural contractors Responsible Person (as recorded on RPS) can submit a claim or mandated users such as agents or business representatives (as recorded on RPS) will be able to claim on behalf of their clients.

A new mandate option “The National Test Program” has been added to the Rural Payment System (RPS) portal which will allow you to confirm this authorisation.

To claim for Soil Sampling you should have claimed land on your Single Application Form in the year of sampling.

The following businesses are not eligible to receive the grants:

- non departmental public bodies

- Local Authorities

- Crown bodies

Organisations that may provide additional information

There are multiple advisory organisations and online resources that will give you information that will support our journey towards lower emissions and increased efficiencies and we have supplied some links to help with this.

Additionally we would want to highlight two organisations that can significantly influence your decisions.

Farming for a Better Climate

Farming for a Better Climate (FFBC) provides practical support to benefit the farm and help reduce our impact on the climate. Taking action as a sector, both to reduce greenhouse gas emissions and to adapt to a changing climate, will secure farm viability for future generations.

FFBC is run by SRUC on behalf of the Scottish Government. We combine ideas trialled by our volunteer Climate Change Focus Farms and information from up-to-the-minute scientific research. We offer practical advice to help you choose the most relevant measures to improve both your farm performance and resilience to future climate change effects.

Farm Advisory Service

Scotland’s Farm Advisory Service (FAS), funded by the Scottish Government, has evolved into a concept well placed to adapt, keep pace with such challenges and provide:

- A range of low and no cost ideas to help farmers identify, support and improve biodiversity on their land;

- Awareness of woodland planting and the benefits for businesses, carbon sequestration and habitat;

- Ideas to help farmers manage carbon on their farm and adapt to a changing climate, making their business more resilient and sustainable to future changes;

- Business management advice such as benchmarking, using data and resource efficient farming as well as responding to specific business challenges and developments including Covid, post-Brexit trading, cattle EID and carbon neutral farming.

Free support exists through events, advice line help, podcasts, technical notes and online tools through the FAS website.

Additionally, every farm and croft in Scotland can apply for up to £3,700 of bespoke advice. This includes a range of topics under Specialist Advice, Integrated Land Management Plans and Carbons Audits.

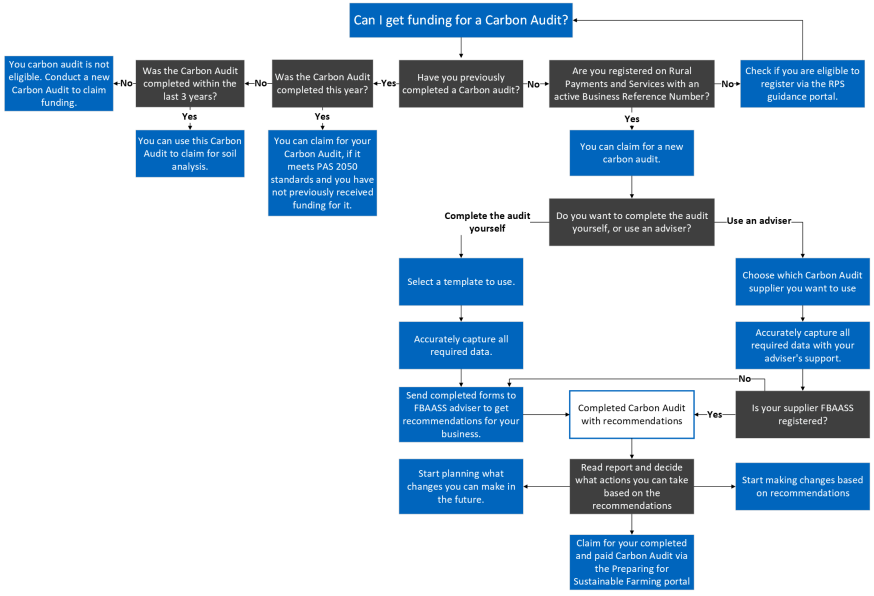

Carbon Audits

The aim of this option is to provide strong encouragement for every farm in Scotland to improve awareness of their Climate performance.

A Carbon Audit establishes a business’s carbon footprint, it identifies the sources and quantities of greenhouse gas emissions on farms and areas where simple changes can lead to improved efficiency, and reduced operating costs and emissions.

The Carbon Audit must be created using a recognised tool such as the Agricultural Resource Efficiency Calculator (AgRE Calc ©) and align to PAS 2050 standard.

Submitting your Carbon Audit tutorial video.

Eligibility

Any farming or crofting business that has an active Business Reference Number and is Rural Payments and Services online registered will be able to claim a standard cost payment of £500 towards having a Carbon Audit (CA) (aligned to the PAS 2050 standard) performed for their business where they do not have one already, or where the current Carbon Audit is more than 3 years old.

The Carbon Audit must have been completed within the scheme year which is the 1st January to the 31st December with the option to claim up to the end of February the following year.

If the business currently has a Carbon Audit (CA) less than 3 years old but it is not aligned to PAS 2050 standard, or there has been a change of enterprise (for instance moving from selling store to selling fat livestock) they are able to have a new Carbon Audit completed and to claim for this.

The Carbon Audit must have been reviewed by and had recommendations from a Farm Business Adviser Accreditation Scheme for Scotland (FBAASS) adviser/associate as to actions that can be taken that will reduce emissions.

You must not claim for any items that you have already received funding for under any other grant schemes including Carbon Audits available under the Farm Advisory Service. This would be regarded as double funding.

To help identify Carbon Audit suppliers please see a non-exhaustive list below.

| Supplier | Web link | Recommendations supplied |

|---|---|---|

| AgRE Calc | AgRE Calc | Yes |

| Farm Carbon Calculator | Farm Carbon Calculator | No |

| Cool Farm Tool | Cool Farm Tool | No |

| Solagro (JRC) Carbon Calculator | Solagro (JRC) Carbon Calculator | No |

(There are more Carbon Audit suppliers available, but you must check that they align to the PAS 2050 standard.)

Please note that some of these Audits will supply the recommendations as part of the audit.

However irrespective of whether they provide the recommendations or not you must get a recommendation for actions that can be taken by your business to reduce the Carbon emissions from a FBAASS accredited adviser/associate, they should have the most up to date ideas and information to help you make improvements.

The recommendations to reduce emissions must be appropriate, such as:

- Improving productivity by producing more kilos or tonnes of meat or crops or litres of milk on the same area of land.

- Increased use of renewable energy, reducing demand on fossil fuels, improving the efficient use of fertiliser or increasing the area of Carbon sinks for your business.

There should be an explanation of the possible emission savings by following the recommendations.

Please refer to Appendix A: Personal Development Links which highlights some reference material that may help with these actions.

Payment Rates

Carbon Audit payment rates have been calculated to partially pay for the time taken for farmers to compile the information to complete the Carbon Audit, the time taken to complete the Audit itself, and to receive the analysis and recommendations from an FBAASS qualified adviser/associate.

The Payment Rate is a standard cost of £500 for an eligible Carbon Audit Claim.

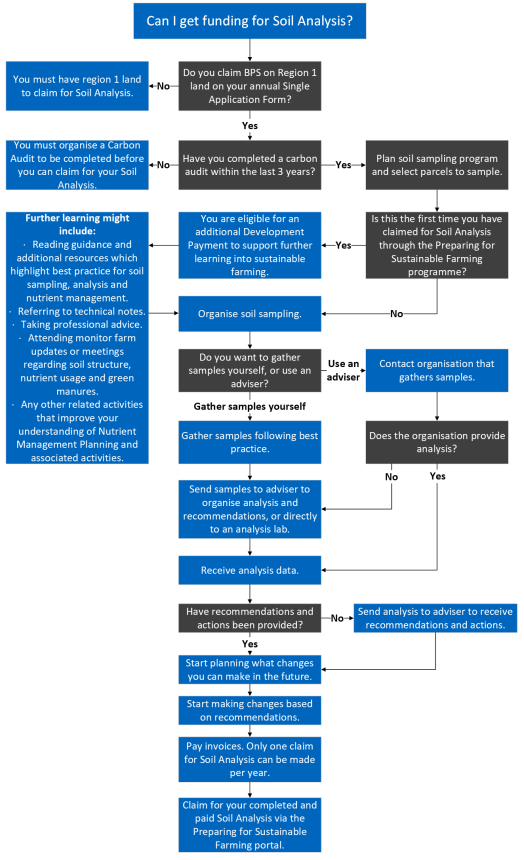

Soil Sampling

Land managers in Scotland claiming Region 1 land on their annual SAF form will be able to claim actual cost up to a calculated maximum value for their soil sampling. With the first claim they will additionally be paid a standard cost payment to cover personal development.

The aim of the option is to improve nutrient planning and nutrient management. This will encourage the best use of nutrients from inorganic and organic fertiliser (including slurry and farmyard manure) by matching applications to crop requirements. It should thus reduce the loss of nutrients to the environment. Additional benefits are reduced diffuse pollution, emissions and improved carbon capture on farmland.

The Soil Analysis and the Development Payment helps farmers target nutrient applications to where they are needed most, improving efficiency of fertiliser use. The process involves:

- Soil analysis to determine the current levels of pH, Phosphate (P), Potash (K), and Carbon in the Soil.

- Working out the crop P, and K nutrient requirements based on the soil analysis (e.g. Using SRUC Fertiliser Technical notes or PLANET (Scotland) software.)

- Estimate the supply of nutrients from organic manures applied based on standard tables or preferably by manure analysis.

- Deduct the estimated manure nutrient supply from crop requirements to find the amount of inorganic fertiliser to be applied.

- Use development time allocation to take part in meetings about improving Soil Structure and Nutrient Management. Research and review the best practice methods, or learn how to carry out soil sampling in future

Submitting your Soil Sampling and Analysis claim tutorial video.

Eligibility

Before you can claim for the Soil Analysis and Development Payment you must confirm that you have a Carbon Audit that aligns to PAS 2050 standards.

The Carbon Audit must have been completed within the previous 3 years from the 1 January in the year of sampling. For example, a Carbon Audit completed 02/02/2022 ensures that a Soil Analysis completed in 02/10/2025 is eligible to claim in 2025 scheme year.

The date your most recent Carbon Audit was completed will be required to confirm that you have a suitable version when you are submitting your claim.

If you have performed a new Carbon Audit under the option covered within this guidance or through FAS or any other route, if it meets the standards set out in this guidance you will meet the criteria to apply for soil sampling support.

If you have performed a new Carbon Audit, the Carbon Audit can be carried out before or after the soil sampling but a valid Carbon Audit must be completed before the claim is submitted for Soil Sampling and Analysis.

A claim for your soil sampling cost may be submitted once annually up to your calculated max allowance with payments restricted to actual cost which need to be evidenced at application. Additional claims will not be considered for payment.

To claim for Soil Sampling and Analysis you should have claimed Region 1 land on your Single Application Form in the year of sampling.

All claims must have supporting documentation uploaded including invoice(s), bank statement(s) and soil analysis results. These should all be dated accordingly to the year of claim. Payment terms where payment is spread over 4 years, for example, are not eligible. For multiyear claims the invoice must be paid in full in the first year.

Soil Sampling

The claimants are encouraged to soil sample their arable land and improved grassland of their farm (Region 1). Recommended best practice is to soil sample at least 20% of Region 1 land annually.

For the purposes of this option we will automatically calculate a maximum soil sampling allowance based on your SAF application from the year of claim.

To calculate your allowance:

- Refer to your Region 1 BPS claimed area on your SAF or farm map on LPIS to calculate the Region 1 area.

- Divide area by 5 (20%)

- Multiply the resultant area by £30 Maximum allowance determined

| Region 1 claimed for BPS area | 20% of R1 area | Value for calculation £30 | Maximum soil sampling allowance |

| 100ha | 100 @ 20% = 20ha | 20ha x £30.00 | £600 |

Claims exceeding maximum allowance will be restricted to calculated maximum value.

Please refer to best practice guidance when taking your samples to ensure the coverage creates an accurate reflection of the condition of your soil.

For the majority of Scottish soils this will be by using Modified Morgan’s solution, although in some areas of the West Highlands and Islands with Calcareous soils, the bicarbonate Olsen test may be more appropriate.

Your normal fertiliser adviser will be able to advise which test is most appropriate and which laboratory to use. The analysis should include recommendations for the planned following crops, based on the recommendations in the relevant SRUC fertiliser technical notes. Using RB209 to base recommendations on is also acceptable but the adviser must take account of Scottish conditions.

The analysis documentation must include details on all of these elements:

pH level, Phosphate (P), Potash (K) and Carbon,

with recommendations that will allow you to plan nutrient applications for your next crop based on Scottish conditions.

It will be of significant benefit for your business to sample for Magnesium and/or for trace elements, this is recommended but not a requirement to be eligible for payment.

The Carbon test may be a Loss on Ignition (LOI), it measures the weight of a dried soil before and after burning away its carbon (in the form of organic matter) which is turned into a percentage, or a Dumas test, which similarly burns the carbon off but uses a higher temperature for a much shorter time. The carbon released is measured as a gas and turned into a percentage. Both methods provide accurate readings of the Carbon levels in your soil.

You may choose to include the Carbon and pH test for every analysed sample or you may choose to combine samples across the parcel and perform as separate Carbon and pH test for every sampled parcel linked to this claim.

If your soil analysis data does not include detail on all four elements, your claim will not be accepted and payment will not be made.

For example: no Carbon data at a parcel level would invalidate your claim.

Actual costs will be paid for your samples analysis based on your invoice net cost (VAT cannot be claimed). An additional payment of £4.00 per tested sample is paid for gathering the soil samples unless this is already included within the cost of the sample analysis.

All payments are restricted to maximum Soil Sampling allowance.

Smaller areas of Region 1 land

To ensure all suitable farming/ crofting businesses can benefit, a minimal soil sampling allowance will be included, this will allow holdings with lower area of Region 1 land to take a different approach which may be more relevant to their business.

To cater for this the maximum soil sampling and analysis allocation is set at £300

This is calculated at 10 ha @ £30 per ha, this will ensure that any business with under 50 ha of Region 1 claimed land will have the opportunity to claim up to £300 of soil sampling based on actual costs claimed.

Example:

| Region 1 claimed for BPS area | 20% of R1 area | Value for calculation £30 | Maximum soil sampling allowance | Minimum allowance rate applied, calculated rate < £300 |

| 25ha | 25 @ 20% = 5ha | 5ha x £30 | £150 | £300 |

All actual cost claims will be restricted to the calculated Maximum. VAT is not claimable.

Development Payment

This payment is to encourage all applicants to spend time researching best practice for soil sampling and nutrient management, referring to technical notes, taking professional advice, attending monitor farm updates, or meetings regarding soil structure, nutrient usage and green manures plus any other related activities that will widen your understanding of Nutrient Management Planning and the associated activities.

Carbon testing is a key element of the soil sampling payment that will be new to most applicants. Therefore time has been included to raise awareness of this element and the long term benefits.

This knowledge of how much Carbon is in their soil will lead farmers to identify ways to build Organic matter which increases the Carbon content, so this development time may be particularly useful.

This time should be used to create or improve existing Nutrient Management plans (free templates are available (Planet software or other commercial programs)). These use crop planning linked to nutrient calculations to improve use of organic and inorganic fertiliser increasing business efficiency, but also minimising waste which in turn mitigates climate change.

This is a standard cost payment of £250.00 that will be paid with your first soil sampling claim if you confirm that you are eligible, during the claim process. Claims in subsequent years will not include a payment for development.

Please refer to Appendix A: Personal Development links which highlights some of the material that is available to start this journey.

Example Soil Sampling Claim

| Region 1 claimed land | 20% of claimed area | Payment rate per ha | Max soil sampling allowance |

|---|---|---|---|

| 100ha | 20 | £30.00 | £600.00 |

| Item | Unit | Cost | Amount |

|---|---|---|---|

| gathering soil sample | Example: 25 samples | £4.00 | £100.00 |

| soil sample analysis paid invoice cost (net VAT) | Example of actual cost | £450.00 | £450.00 |

| Development time: | £250.00 | £250.00 | |

| Claim 1 | £800.00 | ||

| Claim 2 | £550.00 |

The applicant would be paid £800.00 if it was their first claim or £550.00 if it is their second claim.

Whole farm sampling - claims over multiple years

To cater for businesses that have actual costs that exceed their annual allowance there is now flexibility to use the same invoice/ supporting information and claim the remaining actual cost up to the maximum soil sampling allowance in the following years.

The ability to claim for a second section of a whole farm sampling claim that was submitted in 2022 / 2023 / 2024 was delivered in the second half of 2023.

You must have a Carbon Audit that meets the option requirement for the initial claim year.

This is targeted at businesses where they sample all suitable land in one year, and invoiced in the year of sampling and paid at that point, but the cost is greater than the maximum allowance for the business.

In the year that the soil analysis is performed you can claim in the same way as any other claimant with the claim amount restricted to your maximum soil sampling allowance. If this does not cover all your actual costs, there will be an opportunity to claim in subsequent years provided you meet the normal option rules and the points below:

- supporting documents must be dated after 01/01/2022 and require to be supplied with each claim

- invoices from a previous year will only be accepted if you have an associated claim in the previous scheme year

- you can only have one claim for soil analysis per scheme year

- allowance cannot be carried forward to future years if maximum is not claimed

- you must have a Carbon Audit that meets the option requirement for the claim year

- sample Gathering costs can only be claimed once.

- personal development payment is only paid with the first claim

- all other soil analysis rules apply

| Region 1 BPS claimed land | 20% of claimed area | Payment rate per ha | Max soil sampling allowance |

|---|---|---|---|

| 100 ha | 20 | £30.00 | £600.00 |

| Item | unit | claimed | amount |

|---|---|---|---|

| GPS sampling performed by contractor |

Example: 100 samples | N/A | N/A |

| soil sample analysis paid invoice cost (net VAT) |

Example of actual cost: £2,500.00 | £2,500.00 | restricted to allowance: £600.00 |

| Development time: | £250.00 | £250.00 | |

| Claim 1, Paid | £850.00 |

| Item | unit | claimed | amount |

|---|---|---|---|

| GPS sampling performed by contractor |

Example: 100 samples | N/A | N/A |

| soil sample analysis paid invoice cost (net VAT) |

Example of actual cost: £2,500.00 | actual cost - previous paid: £1,900.00 | restricted to allowance: £600.00 |

| Development time: | N/A | N/A | |

| Claim 2, Paid | £600.00 |

| Item | unit | claimed | amount |

|---|---|---|---|

| GPS sampling performed by contractor |

Example: 100 samples | N/A | N/A |

| soil sample analysis paid invoice cost (net VAT) |

Example of actual cost: £2,500.00 | actual cost - previous paid: £1,300.00 | restricted to allowance: £600.00 |

| Development time: | N/A | N/A | |

| Claim 3, Paid | £600.00 |

For this example, the applicant would be paid £850.00 for their first claim then £600.00 in subsequent years, not exceeding actual cost value.

Animal Health and Welfare Interventions

Definition

The aim of this option is to encourage livestock keepers in Scotland to improve the health and welfare of their cattle and sheep, regardless of the size of their business or current health status. It is a “starter package” to prompt a review of your flock or herd, and to help you consider health and welfare interventions that improve performance.

Improved health results in better production efficiency, which means lower greenhouse gas emissions per kg of output. Healthier animals are more productive, require less veterinary intervention and have better welfare than their under-performing counterparts.

The animal health and welfare interventions listed below are well-established protocols to prevent/control disease and improve productivity.

Payment will be made on evidence of investigation plus advised action. The action must be defined by an Expert Adviser, e.g. your vet or agricultural consultant. If you only do the investigation, you will not be eligible for payment. With your first claim, you will also receive a payment of £250 for doing development activities (time spent researching animal health and welfare best practice) appropriate to your flock or herd.

Applicants agree to the collection of data related to livestock health. This data may be shared within Scottish Government and with researchers to help inform future policy decisions. Individual livestock keepers and herds/flocks will not be identifiable from research or policy outputs.

Eligibility

Any farming or crofting business that has an active Business Reference Number, is Rural Payments and Services online registered (including bank account details), and has a flock/herd number (this indicates you are a Registered Keeper with Animal and Plant Health) can choose to undertake up to two interventions from the list below in each year of the Programme. Each intervention would attract a standard payment of £250.

You can claim for the same interventions in year two or three or different ones, to suit your farm business. You will have to submit the standard supporting document (EA form available on the PSF portal) completed by an Expert Adviser (EA) as proof of investigation plus advised action. An EA is a professional from outside the farm business who has the qualifications, and / or experience to provide appropriate advice, e.g. your farm vet or agricultural consultant.

You must complete your investigations and actions for the year by 31 December 2025. Claims must be submitted by 28 February 2026.

You can arrange the investigation(s) for your chosen intervention(s) at a time of year that suits your farm management. You may wish to consult your vet or agricultural consultant on the best time to carry out the investigation and actions. These conversations between farmers and Expert Advisers, will give health and breeding benefits and, in the longer term, help to prepare for sustainable farming.

Carbon Audit

Carbon audit is a recommended step ahead of, or alongside, application for animal health and welfare payments. In the medium term, carbon audit is of real value and can signpost farm priorities and opportunities. Periodic carbon audits quantify progress and map the journey to net zero. It is not mandatory to complete a carbon audit before claiming for animal health and welfare interventions.

Payment Rates

The claim for your animal health and welfare costs can be submitted once annually, up to the maximum allowance. Payment will be restricted to standard costs, meaning you need to provide proof of investigation plus advised action when submitting your claim. Additional claims and late claims will not be considered.

A standard cost of £250 will be paid for each intervention, based on proof of investigation plus advised action, provided on the standard supporting document signed by your Expert Adviser. The standard supporting document can be downloaded from the PSF portal.

All boxes on the form must be filled in. The date intervention complete box, is the date required on the online claim where it asks for ‘date intervention completed’.

No action or N/A is acceptable in the Actions box.

NB: You must not claim for any items that you have already received funding for under any other grant schemes.

ALL BOXES ON THE EXPERT ADVISER DOCUMENT MUST BE COMPLETED. CLAIMS WILL NOT BE PAID UNLESS COMPLETE.

Development Payment

Every applicant making their first claim for animal health and welfare interventions (see table below) will also be paid a standard payment of £250 for development activities (time spent researching animal health and welfare best practice) appropriate to their flock or herd. Your own vet practice, local machinery ring or farmers club may be a source of formal or informal training and/or ideas on best practice. There are many online resources and in-person training opportunities, some examples are given below. This is a one-off payment received with your first claim.

Animal Health and Welfare Interventions

You can select a maximum of two interventions per year from the table below.

| Intervention |

Summary of investigations For more details, see online guidance |

Outline of actions that may be required Fore more details, see online guidance |

| 1. Bull fertility | Bull pre-breeding examination to British Cattle Veterinary Association standard | Vet treatment followed by re-testing and/or culling as needed |

| 2. Calf respiratory disease | Calf respiratory investigation +/- virus screen | Implement sustainable prevention and control plan, including biosecurity measures where relevant, using appropriate expert advice |

| 3. Cattle: liver fluke | Liver fluke investigation | Implement sustainable prevention and control plan, including biosecurity measures where relevant, using appropriate expert advice |

| 4. Cattle: roundworms | Gastrointenstinal parasite (roundworm) investigation: Faecal Egg Count and wormer efficacy testing | Implement sustainable prevention and control plan, including biosecurity measures where relevant, using appropriate expert advice |

| 5. Sheep scab | Screen 12 animals per management group (or all animals in group less than 12) to determine sheep scab status of whole flock. | Implement sustainable prevention and control plan that avoids unnecessary treatment, including biosecurity measures where relevant, using appropriate expert advice |

| 6. Sheep iceberg diseases | Targeted disease investigation (options: Maedi Visna, Johnes, Border Disease, Contagious Lymphadenitis, lung scanning for OPA). Screen cull ewes. | Implement sustainable prevention and control plan, including biosecurity measures for screening and/or isolating purchased and returning stock, using appropriate expert advice |

| 7. Sheep lameness | Flock lameness assessment by vet: identify conditions and their prevalence within the flock | Implement sustainable prevention and control plan, including biosecurity measures where relevant, using appropriate expert advice |

| 8. Sheep: liver fluke | Liver fluke investigation | Implement sustainable prevention and control plan, including biosecurity measures where relevant, using appropriate expert advice |

| 9. Sheep roundworms | Gastrointestinal parasite (worm) investigation (Faecal Egg Count and wormer efficacy testing) | Implement sustainable prevention and control plan, including biosecurity measures where relevant, using appropriate expert advice |

Cattle interventions - detail

1. Bull fertility. Requires a bull breeding soundness test to BCVA (British Cattle Veterinary Association) standard, followed by action: undertake appropriate vet treatment programme if required followed by re-testing and/or culling where appropriate.

The investigation must be carried out by a vet. Advised action(s) will be dependent on the results of testing and must be confirmed in writing by the vet. Action may be limited to monitoring the bull’s breeding performance, may require drug treatment +/- further testing or might mean removing the bull from the breeding herd. NB if removed from the breeding herd, the bull should not be marketed for breeding.

Claims for payment must be accompanied by proof of investigation plus action, provided on the Expert Adviser form signed by your vet or animal health adviser.

2. Calf respiratory disease. Requires a calf respiratory investigation +/- virus screen, followed by action: carry out appropriate remedial action following advice from an Expert Adviser.

The investigation must be done by an Expert Adviser (EA), e.g. an expert in ventilation or a farm vet. The EA might assess building(s), sample calves, review management practices. Advised actions will be dependent on investigation outcomes and must be confirmed in writing by the EA.

Claims for payment must be accompanied by proof of investigation plus action, provided on the Expert Adviser form signed by your vet or animal health adviser.

3. Cattle: liver fluke. Requires a liver fluke investigation and expert advice based on the results.

Liver fluke is a common cause of poor production in Scottish herds. Liver fluke has a complex lifecycle and resistance to treatment (flukicides) is on the increase. These factors can make fluke control difficult. Expert advice that is specific to your herd can make all the difference. In some cases, it even allows farmers to reduce flukicide use, which saves money and time.

All types of liver fluke investigation are now eligible for funding. Your vet or animal health adviser is the best source of advice for what type of investigation would be most beneficial for your herd. We are still encouraging flukicide efficacy testing (details below) but we are now able to accept any type of fluke investigation recommended by your vet or animal health adviser, provided that they provide written advice based on the results to implement a sustainable prevention and control plan for the entire cattle herd and include all other grazing animals in the plan.

Sustainable parasite control means targeting treatment when it is needed. Appropriate diagnostic testing reduces uncertainty around liver fluke control, enabling treatment at the right time with the most appropriate product. There are a number of fluke diagnostic testing options available, each tells you something different about the fluke infection. SCOPS and COWS have produced an excellent guide to test-based control. Use the most appropriate diagnostic test for the time of year, animals sampled and reason for testing, in consultation with your vet or animal health adviser.

Monitoring, through blood testing of sentinel animals (e.g. first season grazers) should be carried out on at least 10 individuals. In most herds, blood testing from early autumn would be appropriate. Faecal egg detection or coproantigen ELISA should be carried out on groups of animals, at least 10 individuals per management group. If using faecal egg detection, at least 10g fresh faeces (= 1 heaped tablespoon) from each animal. For most herds, faecal testing from mid-summer would be appropriate. Samples will be pooled and indicate the presence of adult liver fluke in the herd. Your vet practice or commercial testing lab will do the pooling and testing. We do not advise pooling samples for coproantigen ELISA testing at this time. Coproantigen ELISA test should be repeated 10-14 days after treatment and faecal egg detection should be repeated 21 days after liver fluke treatment, ideally taking samples from the same animals before and after treatment, to see if the treatment has been effective. More information on FEC.

Advised actions will be dependent on test results. Ask your vet/adviser how best to reduce the risk of liver fluke going forward. If the post-treatment egg detection or coproantigen show evidence of active liver fluke infection, seek advice on most appropriate control and treatment options. Advice from the vet/adviser must be confirmed in writing.

Claims for payment must be accompanied by proof of investigation plus action, provided on the Expert Adviser form signed by your vet or animal health adviser.

4. Cattle: roundworms. Requires a gastrointestinal parasite investigation, including wormer efficacy testing. Followed by action: consult an Expert Adviser, implement a sustainable prevention and control plan for the entire herd.

A faecal egg count (FEC) should be carried out on groups of animals e.g. at least 15 individuals per management group (preferably first season grazing calves) and at least 10g fresh faeces from each animal (= 1 heaped tablespoon). Samples will be pooled to assess roundworm infection levels in the herd before treating. Calves can be sampled at various times, but a good starting point would be to take samples from mid-summer through to early autumn, when you would normally expect them to have a worm burden high enough to require treatment. Faecal egg counts in older cattle are difficult to interpret, so speak to your vet/adviser to discuss appropriate timings and options. Alternatively, you can do the FEC yourself, as long as you are confident in carrying out the test and interpreting the result, which must be done in consultation with your vet/animal health adviser in any case. The FEC should be repeated 7-14 days (depending on which wormer was used) after worming to see if treatment has worked. More information on FEC.

Advised actions will be dependent on FEC results. If the initial FEC shows no roundworm eggs present, this does not necessarily mean the animals are free of roundworms, further monitoring is advised. Ask your vet/animal health adviser how best to reduce the roundworm challenge on your farm. If the post-treatment FEC shows roundworm eggs present, they should advise on appropriate control and treatment options. Advice from the Expert Adviser must be confirmed in writing.

Claims for payment must be accompanied by proof of investigation plus action, provided on the Expert Adviser form signed by your vet or animal health adviser.

Sheep interventions - detail

5. Sheep scab. Requires an investigation to determine sheep scab status of whole flock using the sheep scab (ELISA) blood test.

Sheep scab is a costly disease, but because clinical signs can take weeks or months to become apparent, it can easily be missed during the early stages of an infestation. The sheep scab blood test (ELISA) allows for the early and specific detection of exposure to sheep scab and can also provide some assurance that the flock may be free from sheep scab Annual testing of your flock for example ahead of tupping or sales, can show if the flock has been exposed to sheep scab, or is suffering from a current infestation. The legislation then allows farmers to self-report without the need for an official visit by the Local Authority or APHA. Farmers then need to work with their own vet to treat the disease effectively. See below for more details on what a positive blood test result may mean for your flock.

You must screen at least 12 animals from the flock, or 12 from each management group if sheep are separated into different groups/mobs. If the whole flock is less than 12 sheep, test all of them. After testing, make and follow a flock treatment plan that targets treatment appropriately, avoids unnecessary treatment and addresses biosecurity.

The investigation requires blood sampling and this must be done by a vet. Marking the sheep as they are sampled is recommended in case re-sampling or follow-up testing is required. The testing laboratory will report the results directly to your own vet.

If results indicate the flock is negative for sheep scab, you and your vet should make a treatment and management plan to ensure that they stay free of scab, paying particular attention to any purchased or returning animals. This includes your vet’s advice on reducing or increasing treatment or changing to a different treatment option as appropriate for your flock.

If the results are positive, it is likely that the flock has either been recently exposed to sheep scab or is currently infested. As such, they will be put under movement restrictions until a veterinary enquiry has been completed. More information can be found on the Government website: Sheep scab: how to spot and report the disease.

The vet enquiry will aim to determine if the results are consistent with active sheep scab in the flock or previous exposure. This will depend on recent treatments and if any clinical signs are present. If deemed an active infestation, the flock must either be treated using an effective control method* or alternatively, they can be moved to slaughter. Flock restrictions are lifted when APHA is informed either by the keeper that treatment has been carried out and 16 days have elapsed or by the vet that there is no evidence of active infestation in the flock. Once the vet enquiry is complete, you must make a treatment and management plan to prevent re-infestation, with advice from your vet as appropriate. The advised action(s) must be confirmed in writing by your vet.

You can find more information on sheep scab control and prevention on the Moredun Research Institute website, including this short video Stop the Spread.

Claims for payment must be accompanied by proof of investigation plus action, provided on the Expert Adviser form signed by your vet or animal health adviser.

6. Sheep iceberg diseases. Requires a targeted iceberg disease investigation.

Options: MaediVisna, Johnes, Border Disease, Contagious Lymphadenitis, lung scanning for OPA (Ovine Pulmonary Adenomatosis). For more information on these diseases see Iceberg diseases of ewes. Screen cull ewes prior to sale, working with the vet to select suitable “sentinel” animals with low condition scores. The number of ewes will depend on the disease being investigated, e.g. 12 for MaediVisna (or all ewes if you have less than 12), as many as possible for OPA scanning. OPA is difficult to diagnose in the early stages, ultrasound is the best available tool and as many “sentinel” animals as possible should be screened. To guard against false positives, the scanning vet might need to request confirmatory Post Mortems and/or record the scans for verification by experienced practitioners.

Followed by action: work with your vet to implement an agreed prevention programme when the results are negative or a control programme when a disease is identified, including (for example) reviewing the sourcing and screening of replacement breeding stock.

Testing may be a step towards joining disease monitoring schemes, e.g. HiHealth Flockcare; Premium sheep and goat health scheme. The advised action(S) mus be confirmed in writing by the vet.

Claims for payment must be accompanied by proof of investigation plus action, provided on the Expert Adviser form signed by your vet or animal health adviser.

7. Sheep lameness. Requires a flock lameness assessment by vet: identify conditions and their prevalence within the flock.

Followed by action: implement a targeted treatment programme with follow-up monitoring.

The investigation must be done by a vet and should consider all common causes of lameness including Contagious Digital Dermatitis. Advised actions might include avoiding disease introduction, quarantine protocols, treatment, vaccination, selective breeding and/or culling, and will be dependent on investigation outcomes. The advised action(s) must be confirmed in writing by the vet.

Claims for payment must be accompanied by proof of investigation plus action, provided on the Expert Adviser form signed by your vet or animal health adviser.

8. Sheep: liver fluke. Requires a liver fluke investigation and expert advice based on the results.

Liver fluke is a common causes of poor production in Scottish flocks. Fluke has a complex lifecycle and resistance to treatment (flukicides) is on the increase. These factors can make liver fluke control difficult. Expert advice that is specific to your flock can make all the difference. In some cases, it even allows farmers to reduce flukicide use, which saves money and time.

All types of liver fluke investigation are now eligible for funding. Your vet or animal health adviser is the best source of advice for what type of investigation would be most beneficial for your flock. We are still encouraging flukicide efficacy testing (details below) but we are now able to accept any type of fluke investigation recommended by your vet or animal health adviser, provided that they provide written advice based on the results to implement a sustainable prevention and control plan for the entire flock, and include all grazing animals on the farm.

Sustainable parasite control means targeting treatment when it is needed. Appropriate diagnostic testing reduces uncertainty around liver fluke control, enabling treatment at the right time with the most appropriate product. There are a number of fluke diagnostic testing options available, each tells you something different about the fluke infection. SCOPS and COWS have produced an excellent guide to test-based control. Use the most appropriate diagnostic test for the time of year, animals sampled and reason for testing, in consultation with your vet or animal health adviser.

Monitoring, through blood testing of sentinel animals (e.g. first season lambs) should be carried out on at least 10 individuals. For most flocks, blood testing from early autumn would be appropriate. Faecal egg detection or coproantigen ELISA should be carried out on groups of animals, at least 10 individuals per management group. If using faecal egg detection, at least 5g fresh faeces (= 1 heaped teaspoon) from each animal. For most flocks, faecal testing from mid-summer would be appropriate. Samples will be pooled and indicate the presence of adult liver fluke in the herd. Your vet practice or commercial testing lab will do the pooling and testing. We do not advise pooling samples for coproantigen ELISA testing at this time. Coproantigen ELISA test should be repeated 10-14 days after treatment and faecal egg detection should be repeated 21 days after liver fluke treatment, ideally taking samples from the same animals before and after treatment, to see if the treatment has been effective. More information on FEC.

Advised actions will be dependent on test results. Ask your vet/animal health adviser how best to reduce the risk of liver fluke going forward. If the post-treatment egg detection or coproantigen show evidence of active liver fluke infection, they should advise on most appropriate control and treatment options. Advice from the Expert Adviser must be confirmed in writing.

Claims for payment must be accompanied by proof of investigation plus action, provided on the Expert Adviser form signed by your vet or animal health adviser.

9. Sheep: roundworm. Requires a gastrointestinal parasite investigation including wormer efficacy testing.

Followed by action: consult an Expert Adviser, implement a sustainable prevention and control plan for the entire flock/herd.

A faecal egg count (FEC) should be carried out on groups of animals e.g. at least 15 randomly selected individuals per management group and at least 3g fresh faeces per animal (= 1 heaped teaspoon). Samples will be pooled to assess roundworm infection levels in the flock before treating. Sheep can be sampled at various times, but a good starting point would be to take samples from lambs from mid-summer through to the early autumn, when you would normally expect them to have a worm burden high enough to require treatment. Your vet practice or commercial testing lab will do the pooling and testing. Alternatively, you can do the FEC yourself, as long as you are confident in carrying out the test and interpreting the result, which must be done in consultation with your vet/animal health adviser in any case. The FEC should be repeated 7-14 days (depending on which wormer was used) after worming to see if treatment has worked. More information on FEC.

Advised actions will be dependent on FEC results. If the initial FEC shows no roundworm eggs present, this does not necessarily mean the animals are free of roundworms, further monitoring is advised. Ask your vet/animal health adviser about how best to reduce roundworm challenge on your farm. If the post-treatment FEC show worm eggs present, they must advise on future control and treatment options. Advice from the Expert Adviser must be confirmed in writing.

Claims for payment must be accompanied by proof of investigation plus action, provided on the Expert Adviser form signed by your vet or animal health adviser.

Claim process

There is no formal application process to confirm your eligibility for this programme, it is the applicants responsibility to read and digest this guidance on Carbon Audits, Soil Sampling and Analysis and Animal Health and Welfare Interventions to confirm that they meet the conditions detailed for the option(s) that they are choosing to claim.

Claims must be made online via a new online portal which will be accessed from the Preparing for Sustainable Farming (PSF) guidance page on Rural Payments and Services website.

Please Note: You must not claim for any items that you have already received funding for under any other grant schemes or which have been supported by other public funds, this would be regarded as double funding.

To submit a claim you will need to:

- have an active Business Reference Number (BRN)

- be registered for funding with the Scottish Government Rural Payments and Inspections Division (SGRPID)

- have completed the claimed option

- submit for both Carbon Audits and Soil Analysis an invoice, and a copy of your bank statement to show the payment for the options has been made (see Supporting Evidence)

- provide the date of completion, and the name of the company whose Carbon Audit you or your adviser completed

- provide the Farm Business Adviser Accreditation Scheme for Scotland (FBAASS) accredited adviser/associate, registration number

- have the Carbon emissions result of the Carbon Audit measured in Kilos or Tonnes of CO2e, as you need to submit this number as part of the claim

- to claim for Soil Sampling to improve Nutrient Management Planning (NMP) you should have claimed Region 1 land on your Single Application Form in the year of sampling

- have the date of your last Carbon Audit (completed within the last 3 years and aligning with PAS 2050 standards) if you are only wanting to claim for Soil Sampling and Analysis, as this is an eligibility requirement

- submit a copy of your analysis for every field sampled and any fertiliser recommendations to support your Soil Analysis claims

- date of testing and Company details of analysis supplier

- submit all supporting documentation including invoice(s), bank statement(s) and soil analysis results. These should all be dated accordingly to the year of claim. Payment terms where payment is spread over 4 years, for example, are not eligible. For multiyear claims the invoice must be paid in full in the first year

For videos on submitting your Carbon Audit and Soil Sampling claims, visit our tutorial videos.

For Animal Health and Welfare Interventions

- submit your claim for payment with written proof(s) of investigation plus action, provided on the standard supporting document signed by an Expert Adviser. The EA form can be downloaded from the PSF portal. The form needs all business details completed

- if you are claiming for two animal health and welfare interventions, you must submit both claims at the same time

- you must use the date intervention completed from the form(s) to complete the online claim for each Intervention

- invoices and/or proof of payment are not required for Animal Health and Welfare Intervention claims

Further details of what needs to be provided are in the relevant option sections.

If you are not registered, do not have an account, or do not know your login details, visit Business Registration & Maintenance.

As this is an online only scheme, we will send all notifications about the scheme via email. To ensure you receive notifications you should ensure the preferred communication email address SGRPID hold for your business on Rural Payments and Services is correct.

All questions must be answered, and the requested data uploaded to allow your claim to be submitted.

If you enter information which is incorrect or in the wrong format, a prompt will appear telling you how to correct this. You will not be able to continue until you have added the information needed.

Claim deadlines

Claims should be made annually for work that has been completed within the period of 1 January and 31 December.

Invoice must be paid, and claim submitted by the claim deadline date of the last day in February of the following year with the claim window opening 1 March of each scheme year.

e.g. Carbon Audit completed 25/06/2025 must be claimed before 28/02/2026.

Claim window example: PSF options completed in 2025 The claim window runs from 1 March 2025 to 28 February 2026.

We reserve the right to close the claim window earlier than the 28 February 2026.

Please note: claims received late will not be eligible for payment.

How do I claim?

You can now submit a claim for a completed Carbon Audit, Soil Analysis or Animal Health and Welfare intervention(s) using the online functionality.

To do this, please press the 'Start your claim' button on the PSF guidance homepage. This will take you to the easy-to-use claim portal. To start your claim you will need your RPS User name and password. If you are an agent who is mandated to claim on behalf of a business, you will be able to select the business you want to submit a claim for after you have entered your details.

Please note if you wish to submit a claim using an i-phone or the Safari browser you will need to allow pop-ups. Open the Settings app, tap "Safari," and turn off "Block Pop-ups" to allow pop-ups.

Verification

Processing

The claim process has been designed to ensure that all information is gathered during the online submission to allow your claim to be verified and processed efficiently.

We reserve the right to request additional documentation/ evidence if required and no claims will progress to payment until it is verified and confirmed to meet the requirements of the guidance.

Request a Review

If you are not satisfied with a decision we have made regarding your claim, you may wish to ask us for a review. When reviewing a case, we can only consider the information that was originally submitted and will not consider new additional documentation.

A request for review must be submitted to your local SGRPID Area Office in writing (including your case reference number) within 14 days of the date on the decision document.

The review request will be considered by an approving officer who was not involved in the original decision. We will respond in writing within 28 days and this will either confirm, amend, or alter our original decision, and explain what the implications of the new decision will be.

Payment

Payments will be made directly into the Sterling bank account registered with SGRPID.

It is your responsibility to make sure a valid and active Sterling bank account for your business has been registered with us on Rural Payments and Services before submitting your claim evidence. Failure to do so will result in your payment being delayed.

All invoices, receipts, accounts and any other relevant documents relating to the claim must be kept for at least seven years from the date of the final payment. This is a HMRC requirement to retain documentation.

All payments will be made Net of VAT.

Please note your claim may be refused if the supporting evidence does not meet the requirement of the option guidance.

We will not be liable for any costs incurred, such as bank charges, by a delayed claim.

Please note that there may be payment interceptions (offsets) if monies are due from over payments of other schemes.

Contract terms and conditions

Additional Information

Contact Details

Please contact your local area office if you have any questions. Customer service details can be found on the Contact us page.

Supporting Evidence

Invoices must:

- individually describe each item being claimed in full

- detail the supplier and the option being claimed

- be addressed to the same business as detailed in the claim, and it must be as the business is registered on RP&S, and on the business bank account.

- show the supplier’s name, address, VAT number and date

- not be from a supplier who is part of, or linked in any way to, the business submitting the claim

Please see the Invoice example below.

Payment Evidence

You will need to provide copies of your bank or building society statement or business credit card statement so that we can confirm all invoices have been paid in full by your business.

For cheque or BACS payments, the cheque number or transfer reference should be visible on the statement.

You must not make cash payments for any claimed items as there is not a satisfactory audit trail, and we will not be able to pay for your claim.

Acceptable evidence includes a screen shot from an online account, but they must show payment details and bank or building society logos, or a certified report printed from a banking system, they must be as one document and not split into parts.

Where there is insufficient information shown e.g. no business name or no BACS details, please request a bank statement from your bank to submit in place of the screenshot.

You can blank out other personal information that is not required, but bank or building society statements must still clearly show:

- bank or building society’s name and logo

- account holder name in full

- account number

- sort code

- transaction date

- transaction type (including payee ref/cheque number)

- transaction amount

Credit Card Payments

If you pay for any Items with a credit card, the items must be paid from your business credit card, not a personal account or a different business account. The credit card statement(s) must show that all invoices for claimed options have been paid in full by your business.

Soil Analysis

Paperwork must detail fully all claimed soil samples, which will demonstrate:

- Business details of testing company/ laboratory

- Number of samples

- Analysis details for all mandatory elements; PH level, Phosphate (P), Potash (K) and Carbon

- Recommendations for lime and fertilisers, based upon the crop(s) you intend to grow reflecting Scottish conditions

Animal Health and Welfare Interventions

- The evidence for each completed intervention must be provided on the supporting document, signed, and stamped by your chosen Expert Adviser (e.g. farm vet, agricultural consultant).

- Please upload the supporting document(s) when you make your online claim.

- If you have completed two animal health and welfare interventions during the claim year, you must claim for both at the same time and upload both the supporting documents.

Uploading documents

Uploading supporting documents has been designed to be simple and a process that will be similar to what you will have used on other IT systems.

To upload your documents, you need to select “Choose File” and this will allow you to browse through your folders and select the file that you want to upload to support your claim.

- Your file must not be bigger than 30 megabytes, and must be one of the following formats:

- Microsoft Word: .doc, .docx

- PDF: .pdf

- Image: .jfif, .jpg, .jpeg, .png, .gif.

The claim requires at least one supporting document for each type of document requested to be uploaded, but will also allow additional documents to be uploaded. This is to ensure that you can supply enough evidence that you have met the requirements of the option.

Appendix A: Personal Development links

Please note this is not a definitive list, please refer to local advisers for information and local or Scottish sources of information that will inform you about your business.

Example links:

- PLANET

- Technical notes | SRUC

- Farm Advisory Service

- Advice & Grants | Farm Advisory Service

- Carbon audits | Farm Advisory Service

- Skillseeder

- Farm carbon audits: Why, what and how?

- Farming for a Better Climate

- Technical notes | Farm Advisory Service

- Soils resources for farmers from Farm Advisory Service

- Nitrate Vulnerable Zones: guidance for farmers - gov.scot

- The 4 Point Plan (4PP) - Farming and Water Scotland

- Nutrient Management Plan

- Measuring Soil Health - Farm Carbon Toolkit

- Agriculture | Scotland's soils

- Carbon Assets for Soil Health | Soil Association

- A Practical Guide to Monitoring Soil Carbon

- Potash Leaflets - Potash Development Association (PDA)

- Nutrient Management Guide (RB209) | AHDB

- Climate Change resources for farmers from Farm Advisory Service.

- Nutrient Management Guide (RB209) | AHDB The AHDB nutrient management guide gives good guidance about the principles of nutrient management planning, although it is focused on English conditions and recommendations.

- Farm Advisory Service

- Mordeun

- Ruminant Health and Welfare

- Sustainable Control of Parasites (SCOPS)

- Scotland's Healthy Animals

Useful links:

Appendix B: Glossary

| Title | Abbreviation | Description |

| Carbon Audit | CA | Document that gives insights to help reduce your carbon footprint |

| Climate Change Conference of the Parties | COP-26 | Conference about uniting the world to tackle climate change |

| Region 1 land | R1 | Basic Payment Scheme eligible land classification |

| Basic Payment Scheme | BPS | Agricultural support scheme |

| Preparing for Sustainable Farming | PSF | Work stream title |

| National Test Programme | NTP | Government initiative for climate change mitigation |

| Agricultural Reform Implementation Oversight Board | ARIOB | Board consisting of agricultural farms and specialists to advise SG (Scottish Government) officials |

| Scottish Government | SG | |

| Policy development Group | PDG | Specialist Advisory panel |

| World Trade Organisation | WTO | Deals with the global rules of trade between nations |

| Scottish Government Rural Payment and Inspections Division | SGRPID | Paying agency |

| Business Reference Number | BRN | Number allocated to eligible business to allow claims to be linked to payments |

| FBAASS | Nationally recognised quality assured and accredited registration of advisors that are trained to deliver Carbon audits, list held by LANTRA | |

| Publicly Available Standard 2050 | PAS 2050 | A publicly available specification that will enable you to measure the environmental impact of your organisation |

| Farm Advisory Service | FAS | Scottish consultancy and advice service |

| LANTRA | network of professional training providers | |

| Nutrient Management Planning | NMP | Recognised nutrient management planning process |

| Single Application Form | SAF | Annual form for claiming BPS and other annual recurrent schemes |

| Land Parcel Identification System | LPIS | Mapping system that allows customers to view their farm maps online |

| Her Majesty's Revenue and Customs | HMRS | |

| Green box measure | WTO terminology, subsidies in general are identified by "Boxes" which are given the colours of traffic lights; green (permitted), amber (slowdown be reduced). red (forbidden). | |

| Animal Health and Welfare | AHW | |

| Expert Adviser | EA | Subject matter expert that has the qualifications and/or skills to provide expert advice |