Scottish Suckler Beef Support Scheme (Mainland and Islands) full guidance

Date published: 3 January, 2025

For recent changes to this guidance, please see the bottom of the page.

Table of Contents

- Introduction

- Overview of the scheme

- New eligibility condition for 2025 - calving interval

- Claiming subsidy

- Claim submission window

- Eligible animals

- Economic responsibility

- Withdrawals

- Force majeure / exceptional circumstances

- Eligibility checks

- Cattle keeping requirements

- Inspections

- Penalties

- Declarations and undertakings

- Payments

- Our targets

- How we look after information

- Appeals and complaints

- Legal base

- Annex A – non-eligible breeds

- Annex B – single sheet passport example

- Annex C – written list of animals to claim

- Recent changes

- Previous versions

- Download guidance

Introduction

These notes cover the Scottish Suckler Beef Support Scheme (Mainland and Islands). Please read them carefully so you understand the rules of the scheme.

If you have any questions or concerns, please get in touch with your local area office.

Overview of the scheme

- this scheme gives direct support to specialist beef producers. It has an annual budget of £34 million for Scottish mainland claims and £6 million for claims from the Scottish islands.

- the scheme year runs from 1 January to 31 December

- the claim submission period is from 1 January to 14 January the following year. Claims can be made throughout the year and there is no limit to the number of claims you can make

- we pay on male and female calves at least 75 per cent beef bred

- calves must have been born on your Scottish holding and kept there for 30 days

- calves must be the first offspring registered to the dam, or the registered offspring of cattle with an established calving interval of 410 days or less

- animals born on or after 2 December are not eligible until the next scheme year. We consider an animal to be one day old on the day after it was born. So an animal born on 2 December is not 30 days old until after 1 January

- you must keep a herd record book and officially identify cattle on your holding in line with the Cattle Identification Regulations (Scotland 2007)

- we set the payment rate to match the number of eligible animals claimed each scheme year

- we may inspect your holding to check you have met the scheme rules

New eligibility condition for 2025 - calving interval

From 1 January 2025, the Scottish Suckler Beef Support Scheme (SSBSS) includes a new eligibility condition which will both support efficiency of the beef sector, as well as contribute to a reduction of greenhouse gas emissions.

The new condition will incorporate a calving interval threshold of 410 days. This condition will apply to calves born from cows who have an established calving interval. The first calves registered to any dam will be exempt from the calving interval threshold condition and will remain eligible for payment, provided that all other scheme conditions are met. The new condition will relate to the calving interval of individual animals rather than a herd average.

All previous scheme conditions will remain in place. From 1 January 2025, in order to be eligible for payment under the scheme, claimed calves must be either:

- the first offspring registered to a dam

- the registered offspring of cattle with an established calving interval of 410 days or less

The calving interval will be calculated based on ScotEID birth registration data. The calculation will use the birth registration details on ScotEID for the claimed calf and the previous calf born to that dam. All calf births must be registered on ScotEID within 27 days of birth in accordance with the cattle identification and traceability regulations.

A frequently asked questions has been published and includes some of the common questions around the new calving interval condition being introduced from 2025.

Claiming subsidy

Registering with Rural Payments and Services (RP&S)

To apply for this scheme, you must be registered on RP&S.

Find out more on how to register

Maximum number of claims

There is no limit to the number of claims you can make.

Claiming online

Using our online service is the easiest and quickest way to submit your claim. To do this, you must be registered with Rural Payments and Services.

Submitting an application online will help you avoid some simple errors such as claiming for an animal twice or entering an eartag in the wrong format.

The guide to online SSBSS submission will show you how to use the online Scottish Suckler Beef Support Scheme application form to submit your claim.

Our local area offices can help you get online and can discuss what support is available. Even if you have no access to the internet, you may be able to make use of computers in your local area office. Please note we have:

- an online appointment booking service which allows you to book a face to face appointment with a member of our team. To book this please call your local office. You can use this time to help you learn about Rural Payments and Services or talk about any other issues relating to your business.

- a web chat facility where you can speak to a member of staff between the hours of 9.30am to 4.30pm, Monday to Friday

- public-use computers available for you to use free-of-charge to log-in to Rural Payments and Services to complete applications, update your personal details or manage a business.

If you require assistance please contact your local area office for support with your application.

Please note, that our staff can explain how the application should be completed, however they cannot be held responsible for your application – this is your responsibility.

You may also wish to seek help from an advisory firm or business representative to submit your SSBSS application. You will need to mandate them to allow them access to your details. You can do this online when logged into your account, or you and your agent or business representative need to complete a Business Mandate Form (PF05).

More information can be found in our customer services section.

Claiming offline

You can still claim by post using the:

Scottish Suckler Beef Support Scheme (Mainland and Islands) claim form, but please remember online submission is the easiest and quickest way.

You can also access copies of the claim form from your local area office. Completed claim forms should be sent to your local area office. Details can be found in our Contact Us section

We will only accept and acknowledge your claim form if you or your mandated agent has:

- filled in your Main Location Code, business name and address in section one

- filled in the numbers claimed box and location box(es) in section two

- signed and dated the form in section three. If you provide additional separate pages with your claim form (e.g. a written list of eartags), these must also be signed and dated

- supplied ear-tag numbers (see supporting documents for paper claims below)

Supporting documents for paper claims

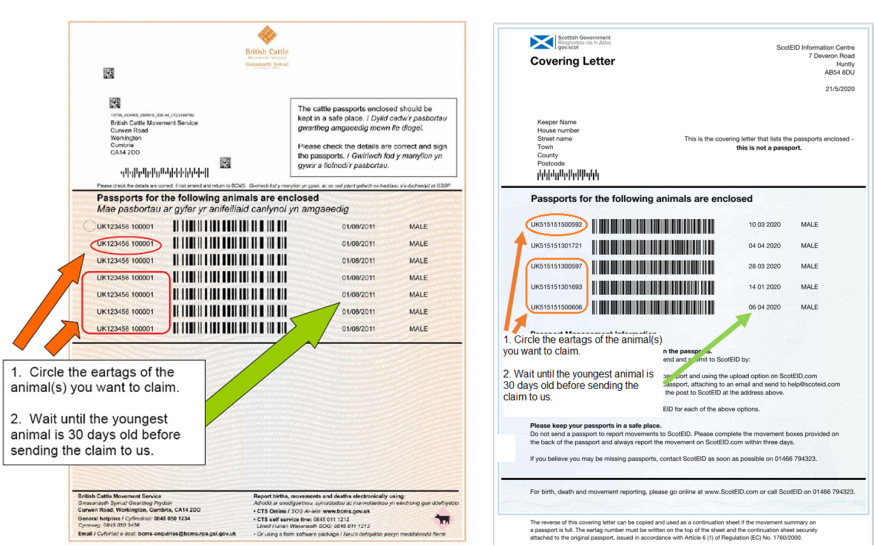

- use the address sheet issued with the single sheet passports from 1 August, 2011 to claim animals. We are unable to return this document to you. Annex B is an example of how to complete this

- you can provide a list of eartags from a farm management software program. Most programs can produce a list in barcode format which also helps us process your claim quickly and accurately

- if you can’t do any of the above we will accept a written list from you in the format shown in Annex C

The total number of single sheet passports, ear-tag numbers circled on address sheets, or eartags provided on an annex c list, must equal the total number of animals you are claiming for.

Remember to sign, date and write your Main Location Code on any list of ear tags you provide. Attach it securely to the claim form.

Claim submission window

Claims can be made throughout the year and there is no limit to the number of claims you can make but you must ensure all claims are submitted within the submission window which opens on 1 January and closes on 14 January the following year.

Producers and agents

Individuals, companies, partnerships, or a group of these can all claim from this scheme.

You can give an agent authority to act for you and sign your claim form. If you use an agent, you must authorise them to act for you.

You can do this online by creating an account with Rural Payments and Services and logging in.

Alternatively, you can download and complete Form PF05 – Business Mandate You can also get this form from your local area office.

Holdings

Your holding is all the production units (farms or crofts) that you manage. Only production units in Scotland are eligible for this scheme.

Single Application Form

To claim for this scheme you must also complete a Single Application Form each year. If you do not do this, your claim will not be valid and we will not make a payment. The main location code you use on your claim form should be the same as the one on your Single Application Form.

Cross Compliance

To be eligible for this scheme you must keep your land in Good Agricultural and Environmental Condition (GAEC) and meet the legal requirements of keeping cattle as part of our Statutory Management Requirements (SMRs).

Find out more about Cross Compliance.

Eligible animals

We pay on calves which:

- you own or lease

- are born on your Scottish holding and kept there continuously from birth for at least 30 days (animals which were too young to claim can be entered on a new application in a subsequent year)

- were born on or after 2 December, 2014

- have a valid cattle passport

- have not been paid under the previous schemes (Scottish Beef Calf Scheme or Scottish Beef Scheme)

- have been correctly officially identified

- are at least 75 per cent beef bred

- calves must be the first offspring registered to the dam, or the registered offspring of cattle with an established calving interval of 410 days or less

Annex A lists breeds that are non-eligible.

Dual purpose breeds

Claimed animals from dual-purpose breeds will only be deemed eligible if they are part of a suckler beef herd – therefore progeny of a cow being used for milk production will not be eligible.

If farmers and crofters, who wish to claim the animals, have both dairy and suckler herds, then they will need to be able to demonstrate that the dam of the claimed animal is not part of the milking herd.

The requirement to be part of a suckler beef herd will apply to all breeds recognised as dual purpose. The relevant breeds currently identified are:

- Montbeliarde

- Meuse Rhine Issel

- Fleckvieh

- Fleckvieh Cross

- Blue Albion

- Blue Albion Cross

- Swedish Red Polled

Economic responsibility

Under the scheme, you must have economic responsibility for the animals which you include in your claim and be able to provide evidence of your ability to meet this requirement if required by RPID. Economic responsibility means that you must be responsible for:

- management of the herd

- feeding

- housing and paying the bills

- veterinary care

- ownership, including receipts from sales, of any progeny

- the selecting of animals brought into or disposed of from the herd

In essence, this means that you must own or have a formal leasing agreement on the animals

included in your claim. Economic responsibility does not include arrangements to buy animals and sell them back to the original owner, whether for a single or multiple scheme years and/or where the original owner undertakes day-to-day management of the herd. If you have some other arrangement which you think may entitle you to claim SSBSS, contact your SGRPID Area Office before you complete your claim form.

Withdrawals

You can write to us to withdraw an entire claim or individual animals at any time. But not if we have told you we will be inspecting your holding, or have told you about any errors in your claim.

Force majeure / exceptional circumstances

If you have been unable to comply with the rules of the scheme as a result of force majeure/exceptional circumstances, you may retain the right to aid in respect of the claimed animal numbers.

To apply for force majeure/exceptional circumstances, you must write to your RPID area office within 15 working days from the date you are in a position to do so. You will need to send us as much evidence as you can to show the failure to comply with the scheme rules was solely due to the force majeure/exceptional circumstances event.

Some examples of a force majeure/exceptional circumstance event are:

- the death of the beneficiary

- long-term professional incapacity of the beneficiary

- a severe natural disaster gravely affecting the holding

- the accidental destruction of livestock buildings on the holding

- an epizootic or a plant disease affecting part or all of the beneficiary’s livestock or crops respectively

- expropriation of all or a large part of the holding if that expropriation could not have been anticipated on the day of lodging the application

This is not an exhaustive list and animal health concerns, weather conditions, bull failure or transport issues may also qualify as force majeure/exceptional circumstances. You should bear in mind that these are only examples and they are not, by themselves, sufficient to qualify as force majeure/exceptional circumstances and you will still need to provide evidence in support of these events. Normal commercial risks cannot be considered as force majeure or exceptional circumstances.

The notion of force majeure contains two elements:

- an objective element relating to abnormal circumstances unconnected with the business in question and beyond its control

- a subjective element involving the obligation to guard against the consequences of the abnormal event by taking all appropriate steps without making unreasonable sacrifices

Therefore, for any scenario to be considered as a force majeure or exceptional circumstance event, a business must be able to provide documentary evidence which demonstrates that the event which prevented them from meeting their scheme obligations, was an abnormal circumstance. A business must also be able to demonstrate that the consequences of the event could not be avoided in spite of the exercise of all due care and that they have taken all appropriate measures to guard against the consequences of the abnormal event.

The SSBSS 2025 frequently asked questions includes examples to illustrate the type of evidence that may be relevant.

The decision on whether a situation is recognised as a case of force majeure is taken on a case-by-case basis using relevant documentary evidence provided.

Eligibility checks

We will check by inspections and administrative checks that you have met the eligibility requirements detailed above. Where ineligible animals/claims are found your payment will be reduced in accordance with the scheme penalties outlined within this guidance.

We will check all the animals you claim with ScotEID ScotMoves+ system.

To check the ScotMoves+ records for your animals, you can visit ScotEID.

Each eligible animal must only be claimed once. If you duplicate a claim for an animal in the same year or a subsequent year, we will treat this as an over-declaration and apply penalties.

You can avoid this by checking your claim record each and every time before you claim.

If an animal has failed validation as it was too young it can be entered again on a claim form in a subsequent year

Calving interval eligibility

An administrative penalty will not be applied to calves which fail to meet the calving interval condition and these animals will be deducted from a claim without penalty. All claimed calves must continue to meet all other existing scheme requirements and will be deducted with penalty where this is not the case.

For example, a claimed animal that does not meet an existing scheme eligibility requirement (e.g. not 75% beef bred) and which also fails to meet the calving interval condition will be deducted with penalty. A claimed animal that meets all existing scheme requirements but does not meet the calving interval condition will be deducted without penalty.

Cattle keeping requirements

The Cattle Identification (Scotland) Regulations 2007, as amended, require cattle keepers to keep a herd register of all the animals on each of their County Parish Holding (CPH) locations for 10 years. These regulations also detail the rules on eartags.

Records and tagging must be accurate and up to date, or you may lose payments.

You can get further details on cattle identification and traceability rules in the Scottish Government Livestock Traceability guidance or by contacting the ScotEID helpline.

Inspections

We will inspect the cattle you claim under the scheme as part of our existing Cattle Identification Inspection programme.

We will check that you have met the scheme’s rules, as detailed in the relevant European Commission regulations and implemented and enforced by the Cattle Identification (Scotland) Regulations 2007, as amended.

Detailed guidance can be found in our Cattle identification inspections section.

You must allow us to inspect your records and animals at any reasonable date and time. We may ask you to gather your animals at a convenient place on the holding and you must provide secure handling facilities to allow us to check each animal’s ear tag.

We may not warn you about any inspection we plan to carry out and we may inspect your holding more than once a year.

We will not pay your subsidy and you could face prosecution if you:

- refuse to let us inspect your holding and animals

- prevent our inspector from coming onto your holding

- do not give reasonable help to the inspector

At an inspection we will check:

- By means of a physical inspection that claimed animals have been correctly identified with two matching official identifiers and breed, sex, age and location of the claimed animals match the submitted claim details

- that your herd register contains all mandatory birth, movement and death information as applicable. We may also check supporting documents, such as purchase and sales receipts and slaughter certificates

- That claimed animals have a valid official passport

- That ScotEID ScotMoves+/ ScotMoves systems have been notified of births, movements and deaths of claimed animals as applicable.

- As a keeper of cattle, your identification and traceability requirements can be found in the Scottish Government livestock identification and traceability guidance

Penalties

General

You will lose some or all of your payment if you do not meet the rules of the scheme and the undertakings you give.

You may be prosecuted if you knowingly make a false statement to receive payment for yourself or for someone else.

So it’s important to make sure you understand your responsibilities and we would advise you to seek professional advice if you need it.

Scheme penalties

You may face a penalty if you claim for animals that do not meet the rules of the scheme.

From scheme year 2021 a review of the penalty regime changed the way penalties are applied. There is now only one penalty level, so for 2021 applications onwards, if we find a difference between the number of animals claimed and the number of animals that are eligible, we will reduce a payment using a percentage error rate which is calculated by dividing the number of animals found to be not eligible by the number of animals that are eligible

For example:

If you claim 100 animals but 10 of these are not eligible, the percentage error calculation would be:

10 (animals not eligible) ÷ 90 (remaining eligible animals) x 100 = 11.1 per cent

This means that we pay premium on 90 animals and reduce the payment by 11.1 per cent.

In scheme years 2015-2020, there were five levels of penalty. If you have a query regarding a penalty applied in these years, please contact your local RPID area office.

False declaration

If you knowingly make a false statement in an application, we will apply a fine to other payments you are entitled to over the following three scheme years.

The fine will be equivalent to the payment you would have received had there been no errors in your application.

Penalties for not following Cross Compliance

You may face a penalty:

- if you do not keep your land in good agricultural and Environmental Condition (GAEC)

- if you do not keep to the statutory management requirements (SMR), which include the animal identification regulations

- More information can be found in our Cross Compliance section

Penalties for using banned substances

We may exclude you from the scheme for a year if we find:

- that you have used banned substances (for example, hormones) on your animals or we find these substances on your premises

- we find residues of substances in your animals (for example, medicines) which you have used illegally, or we find these substances stored illegally on your premises

If we exclude you from the scheme for using banned substances and you repeat this offence, we may exclude you for up to five years. If you prevent us from inspecting your holding or taking samples to check for banned substances, we may exclude you from the scheme.

Penalties for submitting your Single Application Form (SAF) late

If we receive your Single Application Form after the deadline we will reduce your payment. You can find out more about the Single Application Form and how to complete it online.

Using our online service is the quickest and easiest way to submit your form each year.

Declarations and undertakings

You must read the declarations and undertakings at section three of your SSBSS claim form carefully before you sign the form.

Payments

Sterling

All payments will be made in Sterling.

If you haven’t provided a Sterling bank account to RPID before you will need to follow the guidance below. We can only accept a UK bank account in the name of the business or in the name of business member linked to the business. Each business must have a unique bank account. We will not accept bank accounts already known to us under a different business record.

Watch the tutorial video on how provide your bank details online.

Payments by BACS

We make payments under using the Bankers Automated Clearing Services (BACS).

We can only make payments to a bank account which accepts BACS payments. If we do not already have your business’ nominated bank account details, or if you want to change them, you can do this online (see video above).

Alternatively, you can fill in a Register your Bank Details Form – Sterling (PF03) and send it to your area office.

Please keep your bank details up to date in your Rural Payments and Services account to avoid payment delays.

Please note, if you register a new bank account or tell us of a change to your bank account, we will carry out checks for your security. These take at least 10 days and we cannot make payments during this period.

We are not responsible for delays to your payments because you or your agent gave us incorrect bank details or did not tell us about a change to your bank account details before we processed your payment(s).

We will not process requests for mandates.

Payment rates

The payment rate for eligible animals is not fixed. The rate will vary each year depending on the total number of eligible animals claimed in the calendar year. We pay a flat rate for each eligible animal.

The yearly rates will be set once the total number of eligible animals claimed is known, which is normally around March.

Our targets

We can only process your claim if you fill it in correctly and include all the documents we need to support it.

We aim to:

- acknowledge your claim by letter within 14 days

- to pay all eligible claims by 30 June following the end of each scheme year

How we look after information

We take our responsibilities for the way we store, secure and use your personal information seriously, and always seek to respect your privacy and to meet our legal obligations. These obligations include the UK General Data Protection Regulation, the UK Data Protection Act 2018, and other regulations and legislation relating to privacy and communications.

To see details on how we use your information and who we share your information with, please see our privacy policy or available in paper form from your area office.

Our Privacy Policy explains the purposes for which we use personal data and the legal basis for that use. It explains our responsibilities for collecting data and what happens if you fail to provide data we need or provide incorrect data. We set out the categories of data we collect and how we acquire it, especially in those cases where it may come from another party.

The Privacy Policy also sets out our approach to sharing data and gives information about the organisations with whom we share data and why we do so. Finally, we advise you of your various rights and how to exercise them.

If you are providing information to us on behalf of someone else (for example, as an agent representing a beneficiary), you are advised to draw this section of the Guidance and the Privacy Policy to the attention of any individual whose data is being processed. This is in order to help you fulfil your obligations under data protection legislation towards your clients or those whom you represent.

Appeals and complaints

If you are unhappy with a decision we have made regarding your claim or if you are unhappy with the service we have provided you with, you can make use of our appeals and complaints procedures.

You can find out more about both below.

Legal base

Our legal authority for this scheme is in two parts.

- European Parliament and the Council Regulation 1307/2013 that deals with the basic rules of the scheme

- European Parliament and Council Regulation 1306/2013 that deals with requirements that are more general

- Common Agricultural Policy (Direct Payments etc.) (Scotland) Regulations 2015 as amended

- the following also has to be adhered to regarding animals: Regulation (EC) 1760/2000 as amended

These regulations are supplemented with other regulations, and you should note in that respect that EU legislation has now been rolled over into domestic law as ‘assimilated EU law’.

If you would like to know the full range of regulations, speak to your local area office.

We aim to provide as much guidance as is practicable on the scheme. It is not however a definitive statement of the effect of the relevant legislation, which can only be provided by the courts. If you have any legal questions, you should get appropriate legal advice from a solicitor.

Annex A – non-eligible breeds

- Armoricaine

- Ayrshire

- Ayrshire Cross

- Black and White Friesian

- Belted Dutch

- Belted Dutch Cross

- Bretonne Pie-Noire

- British Friesian

- British Friesian Cross

- British Holstein

- British Holstein Cross

- Brown Swiss

- Brown Swiss Cross

- Cross breed Dairy

- Dairy Shorthorn

- Dairy Shorthorn Cross

- Deutsche Schwartzbunte and Swartzbunte Milchrasse

- Estonian Red

- Estonian Red Cross

- Francaise Frisonne Pie Noire

- Fries Holland

- Frisona Espagnola

- Frisona Espagnola Cross

- Frisona Italiana

- Friesian

- Friesian Cross

- Groninger Blaarkop

- Guernsey

- Guernsey Cross

- Holstein Friesian

- Holstein Friesian Cross

- Holstein

- Holstein Cross

- Jersey

- Jersey Cross

- Kerry

- Kerry Cross

- Northern Dairy Shorthorn

- Red and White Friesian

- Reggiana

- Red and White Friesian

- Sortbroget Dansk Maelkerace

- Swiss Gray

- Swedish Red

- Swedish Red Cross

- Swedish Red and White

- Yak

- Zwartbonten van Belge / Pie-Noire de Belgique

- or any other dairy breed

Annex B – single sheet passport example

Annex C – written list of animals to claim

Recent changes

| Section | Change |

|---|---|

| Force majeure/exceptional circumstances | New section added |

| Payments | Figures updated for 2017 |

Previous versions

Download guidance

Click 'Download this page' to create a printer-friendly version of this guidance that you can save or print out.