Preparing for Sustainable Farming full guidance

This is an old version of the page

Date published: 29 April, 2022

Date superseded: 10 February, 2023

Table of Contents

- Introduction

- Who can claim

- Organisations that may provide additional information

- Options under Preparing for Sustainable Farming (PSF)

- Claim process

- Verification

- Payment

- Contract terms and conditions

- Additional Information

- Appendix A: Personal Development links

- Appendix B: Glossary

Introduction

The Cabinet Secretary announced in October 2021 that a National Test Programme was to be developed to support farmers and crofters to play their part in Scotland becoming a global leader in sustainable and regenerative agriculture.

The Programme will support and encourage farmers and crofters to learn about how their work impacts on climate and nature. The Agriculture Reform Implementation Oversight Board (ARIOB) was established with several stakeholders from across the Scottish Agricultural and wider rural economy, and the Policy Development Group (PDG), which includes external members, was set up to provide advice to Scottish Government officials to direct the National Test Programme scheme going forward.

Preparing for Sustainable Farming (PSF), the first part of this Programme, is live from spring 2022 and will help ensure that when the new rural support regime is introduced we will integrate enhanced conditionality of at least half of all funding for farming and crofting by 2025 and as part of this conditionality, expect recipients of support to deliver on targeted outcomes for biodiversity gain and low emissions production.

Conditionality means that in the future Climate mitigation and how Biodiversity is looked after and encouraged by businesses, will be a condition businesses have to meet to receive agricultural support payments.

Preparing for Sustainable Farming (PSF) focuses on incentives to farmers and crofters to help them understand their Carbon emissions and sequestration, identifying recommendations that can lower these emissions and increase efficiencies.

It is recognised that there is a population already engaged with climate mitigation but we need to widen the opportunity and engagement with the industry if we are going to reduce its emissions in line with the Climate Change Plan.

There are two options currently being funded in the first phase of Preparing for Sustainable Farming (PSF) that Scottish farmers, crofters, and agricultural contractors can claim funding for.

These two options are:

- Carbon Audits

- Soil Sampling and Analysis.

Preparing for sustainable farming - full scheme guidance (PDF 785KB)

Additionally within this first phase of Preparing for Sustainable Farming we are providing Suckler beef producers access to MyHerdStats. This is a new online tool that securely presents herd management information within the ScotEID system utilising your existing login details.

MyHerdStats, developed by ScotEID, is a software tool that utilizes statutory cattle traceability data to provide cattle keepers with a consistent and accurate insight into their herd performance to help highlight opportunities to improve business and environmental benefits.

Cattle keepers can gain access to a selection of herd performance indicators and trends, for example:

- Cows retained percentage,

- Calves registered,

- Cows calved,

- Values of cow and heifer efficiency,

- Cow and calf mortalities,

- Sale date profile for breeding and youngstock.

Over time MyHerdStats will be developed to incorporate additional functionality. MyHerdStats is now available to every cattle keeper in Scotland by signing into their ScotEID account using their username and password.

Once the keeper has logged in, click on the tab ‘MyHerdStats’ which can be found under Cattle – ScotMoves+ - Open MyHerdStats, within the drop-down list on the left-hand side of the screen.

Legal Basis

The National Test Programme is operated under the Environmental Protection Act 1990 (the 1990 Act).

This provides the Scottish Ministers with a wide range of grant making powers in the field of environmental protection and includes the power to give financial assistance supported by Scottish Statutory Instruments 2022 No. 8.

The National Test Programme has been classified as a Green box measure under the World Trade Organisation (WTO) Agreement on Agriculture (AoA).

Who can claim

Scottish farmers, crofters and agricultural contractors (based in Scotland), can claim for this grant if they:

- are registered for funding with Scottish Government Rural Payments and Inspections Division (SGRPID)

- have a Rural Payments and Services (RPS) username and password

Registered farmers or crofters registered as the Responsible person can submit a claim or mandated users will be able to claim on behalf of their clients.

A new mandate option “The National Test Program” is being added to the Rural Payment System (RPS) portal which will allow you to confirm this authorisation. This will be available May 9th 2022.

To claim for Soil Sampling you should have claimed land on your Single Application Form in the year of sampling.

The following businesses are not eligible to receive the grants:

- non departmental public bodies

- Local Authorities

- Crown bodies

Organisations that may provide additional information

There are multiple advisory organisations and online resources that will give you information that will support our journey towards lower emissions and increased efficiencies and we have supplied some links to help with this.

Additionally we would want to highlight two organisations that can significantly influence your decisions.

Farming for a Better Climate

Farming for a Better Climate (FFBC) provides practical support to benefit the farm and help reduce our impact on the climate. Taking action as a sector, both to reduce greenhouse gas emissions and to adapt to a changing climate, will secure farm viability for future generations.

FFBC is run by SRUC on behalf of the Scottish Government. We combine ideas trialled by our volunteer Climate Change Focus Farms and information from up-to-the-minute scientific research. We offer practical advice to help you choose the most relevant measures to improve both your farm performance and resilience to future climate change effects.

Farm Advisory Service

Scotland’s Farm Advisory Service (FAS), funded by the Scottish Government, has evolved into a concept well placed to adapt, keep pace with such challenges and provide:

- A range of low and no cost ideas to help farmers identify, support and improve biodiversity on their land;

- Awareness of woodland planting and the benefits for businesses, carbon sequestration and habitat;

- Ideas to help farmers manage carbon on their farm and adapt to a changing climate, making their business more resilient and sustainable to future changes;

- Business management advice such as benchmarking, using data and resource efficient farming as well as responding to specific business challenges and developments including Covid, post-Brexit trading, cattle EID and carbon neutral farming.

Free support exists through events, advice line help, podcasts, technical notes and online tools through the FAS website.

Additionally, every farm and croft in Scotland can apply for up to £3,700 of bespoke advice. This includes a range of topics under Specialist Advice, Integrated Land Management Plans and Carbons Audits.

Options under Preparing for Sustainable Farming (PSF)

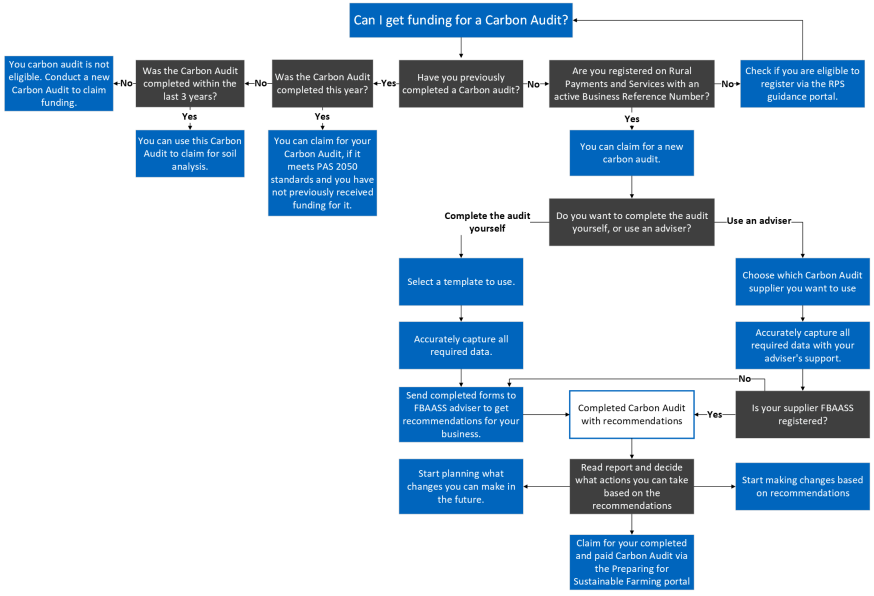

Carbon Audits

The aim of this option is to provide strong encouragement for every farm in Scotland to improve awareness of their Climate performance.

A Carbon Audit establishes a business’s carbon footprint, it identifies the sources and quantities of greenhouse gas emissions on farms and areas where simple changes can lead to improved efficiency, and reduced operating costs and emissions.

The Carbon Audit must be created using a recognised tool such as the Agricultural Resource Efficiency Calculator (AgRE Calc ©) and align to PAS 2050 standard.

Eligibility

Any farming or crofting business that has an active Business Reference Number and is Rural Payments and Services online registered will be able to apply to receive a standard cost payment of £500 towards having a Carbon Audit (CA) (aligned to the PAS 2050 standard) performed for their business where they do not have one already, or where the current Carbon Audit is more than 3 years old.

The Carbon Audit must have been completed after 01/01/2022 to be eligible for payment under this scheme.

If the business currently has a Carbon Audit (CA) less than 3 years old but it is not aligned to PAS 2050 standard, they are able to have a new Carbon Audit completed and to claim for this.

The Carbon Audit must have been reviewed by and had recommendations from a Farm Business Adviser Accreditation Scheme for Scotland (FBAASS) adviser/associate as to actions that can be taken that will reduce emissions.

You must not claim for any items that you have already received funding for under any other grant schemes including Carbon Audits available from the Farm Advisory Service. This would be regarded as double funding.

To help identify Carbon Audit suppliers please see a non-exhaustive list below.

| Supplier | Web link | Recommendations supplied |

|---|---|---|

| AgRE Calc | AgRE Calc | Yes |

| Farm Carbon Calculator | Farm Carbon Calculator | No |

| Cool Farm Tool | Cool Farm Tool | No |

| Solagro (JRC) Carbon Calculator | Solagro (JRC) Carbon Calculator | No |

(There are more Carbon Audit suppliers available, but you must check that they align to the PAS 2050 standard.)

Please note that some of these Audits will supply the recommendations as part of the audit.

However irrespective of whether they provide the recommendations or not you must get a recommendation for actions that can be taken by your business to reduce the Carbon emissions from a FBAASS accredited adviser/associate, they should have the most up to date ideas and information.

The recommendations to reduce emissions must be appropriate, such as:

- Improving productivity by producing more kilos or tonnes of meat or crops or litres of milk on the same area of land.

- Increased use of renewable energy, reducing demand on fossil fuels, improving the efficient use of fertiliser or increasing the area of Carbon sinks for your business.

There should be an explanation of the possible emission savings by following the recommendations.

Please refer to Appendix A: Personal Development Links which highlights some reference material that may help with these actions.

Payment Rates

Carbon Audit payment rates have been calculated to partially pay for the time taken for farmers to compile the information to complete the Carbon Audit, the time taken to complete the Audit itself, and to receive the analysis and recommendations from an FBAASS qualified advisor/associate.

The Payment Rate is a standard cost of £500 for an eligible Carbon Audit Claim.

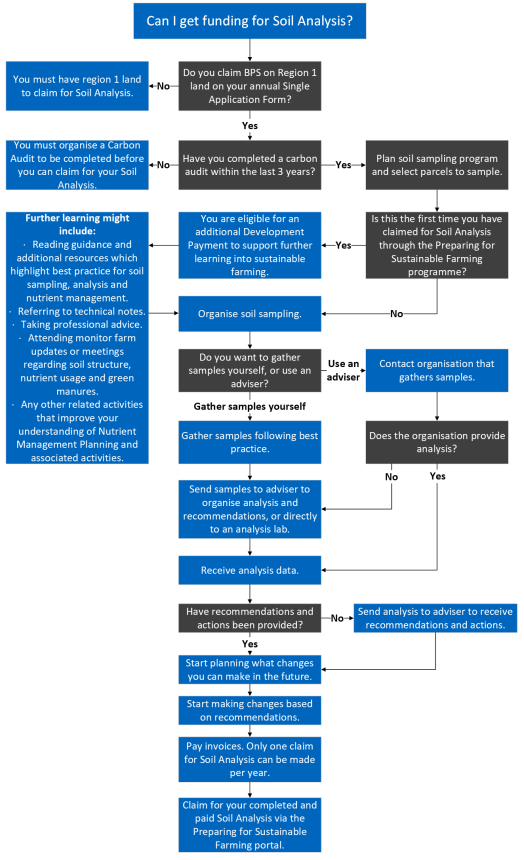

Soil Sampling to improve Nutrient Management Planning (NMP)

Land managers in Scotland claiming Region 1 land on their annual SAF form will be able to claim actual cost up to a calculated maximum value for their soil sampling. With the first claim they will additionally be paid a standard cost payment to cover personal development.

The aim of the option is to improve nutrient planning and nutrient management. This will encourage the best use of nutrients from inorganic and organic fertiliser (including slurry and farmyard manure) by matching applications to crop requirements. It should thus reduce the loss of nutrients to the environment. Additional benefits are reduced diffuse pollution, emissions and improved carbon capture on farmland.

The Soil Analysis and the Development Payment helps farmers target nutrient applications to where they are needed most, improving efficiency of fertiliser use. The process involves:

- Soil analysis to determine the current levels of pH, Phosphate (P), Potash (K), and Carbon in the Soil.

- Working out the crop P, and K nutrient requirements based on the soil analysis (e.g. Using SRUC Fertiliser Technical notes or PLANET (Scotland) software.)

- Estimate the supply of nutrients from organic manures applied based on standard tables or preferably by manure analysis.

- Deduct the estimated manure nutrient supply from crop requirements to find the amount of inorganic fertiliser to be applied.

- Use development time allocation to take part in meetings about improving Soil Structure and Nutrient Management. Research and review the best practice methods, or learn how to carry out soil sampling in future

Eligibility

Before you can claim for the Soil Analysis and Development Payment you must confirm that you have a Carbon Audit that aligns to PAS 2050 standards.

The Carbon Audit must have been completed within the previous 3 years from the 1st of January in the year of sampling. For example a Carbon Audit completed 02/02/2019 ensures that at Soil Analysis completed in 02/10/2022 is eligible to claim.

The date the previous Carbon Audit was completed will be required to confirm that you have a suitable version when you are submitting your claim.

If you have performed a new Carbon Audit under the option covered within this guidance or through FAS or any other route, as long as it meets the standards set out in this guidance you will meet the criteria to apply for soil sampling support.

A claim for your soil sampling cost may be submitted once annually up to your calculated max allowance with payments restricted to actual cost which need to be evidenced at application. Additional claims will not be considered for payment.

To claim for Soil Sampling and Analysis you should have claimed Region 1 land on your Single Application Form in the year of sampling.

Soil Sampling

The claimants are encouraged to soil sample their arable land and improved grassland of their farm (Region 1). Recommended best practice is to soil sample at least 20% of Region 1 land annually.

For the purposes of this option we will automatically calculate a maximum soil sampling allowance based on your SAF application from the year of claim.

To calculate your allowance:

- Refer to your Region 1 BPS claimed area on your SAF or farm map on LPIS to calculate the Region 1 area.

- Divide area by 5 (20%)

- Multiply the resultant area by £30 Maximum allowance determined

| Region 1 claimed for BPS area | 20% of R1 area | Value for calculation £30 | Maximum soil sampling allowance |

| 100ha | 100 @ 20% = 20ha | 20ha x £30.00 | £600 |

Claims exceeding maximum allowance will be restricted to calculated maximum value.

Please refer to best practice guidance when taking your samples to ensure the coverage creates an accurate reflection of the condition of your soil.

For the majority of Scottish soils this will be by using Modified Morgan’s solution, although in some areas of the West Highlands and Islands with Calcareous soils, the bicarbonate Olsen test may be more appropriate.

Your normal fertiliser advisor will able to advise which test is most appropriate and which laboratory to use. The analysis should include recommendations for the planned following crops, based on the recommendations in the relevant SRUC fertiliser technical notes.

The analysis documentation must include details on all of these elements:

pH level, Phosphate (P), Potash (K) and Carbon,

with recommendations that will allow you to plan nutrient applications for your next crop based on Scottish conditions.

It will be of significant benefit for your business to sample for Magnesium and/or for trace elements, this is recommended but not a requirement to be eligible for payment.

The Carbon test may be a Loss on Ignition (LOI), it measures the weight of a dried soil before and after burning away its carbon (in the form of organic matter) which is turned into a percentage, or a Dumas test, which similarly burns the carbon off but uses a higher temperature for a much shorter time. The carbon released is measured as a gas and turned into a percentage. Both methods provide accurate readings of the Carbon levels in your soil.

You may choose to include the Carbon and pH test for every analysed sample or you may choose to combine samples across the parcel and perform as separate Carbon and pH test for every sampled parcel linked to this claim.

If your soil analysis data does not include detail on all four elements, your claim will not be accepted and payment will not be made.

For example: no Carbon data at a parcel level would invalidate your claim.

Actual costs will be paid for your samples analysis based on your invoice net cost (VAT cannot be claimed). An additional payment of £4.00 per tested sample is paid for gathering the soil samples unless this is already included within the cost of the sample analysis.

All payments are restricted to maximum soil sampling allowance.

Smaller areas of Region 1 land

To ensure all suitable farming/ crofting businesses can benefit, a minimal soil sampling allowance will be included, this will allow holdings with lower area of Region 1 land to take a different approach which may be more relevant to their business.

To cater for this the maximum soil sampling and analysis allocation is set at £300

This is calculated at 10 ha @ £30 per ha, this will ensure that any business with under 50 ha of Region 1 claimed land will have the opportunity to claim up to £300 of soil sampling based on actual costs claimed.

Example:

| Region 1 claimed for BPS area | 20% of R1 area | Value for calculation £30 | Maximum soil sampling allowance | Minimum allowance rate applied, calculated rate < £300 |

| 25ha | 25 @ 20% = 5ha | 5ha x £30 | £150 | £300 |

All actual cost claims will be restricted to the calculated Maximum. VAT is not claimable.

Development Payment

This payment is to encourage all applicants to spend time researching best practice for soil sampling and nutrient management, referring to technical notes, taking professional advice, attending monitor farm updates, or meetings regarding soil structure, nutrient usage and green manures plus any other related activities that will widen your understanding of Nutrient Management Planning and the associated activities.

Carbon testing is a key element of the soil sampling payment that will be new to most applicants. Therefore time has been included to raise awareness of this element and the long term benefits.

This knowledge of how much Carbon is in their soil will lead farmers to identify ways to build Organic matter which increases the Carbon content, so this development time may be particularly useful.

This time should be used to create or improve existing Nutrient Management plans (free templates are available (Planet software or other commercial programs)). These use crop planning linked to nutrient calculations to improve use of organic and inorganic fertiliser increasing business efficiency, but also minimising waste which in turn mitigates climate change.

This is a standard cost payment of £250.00 that will be paid with your first soil sampling claim if you confirm that you are eligible, during the claim process. Claims in subsequent years will not include a payment for development.

Please refer to Appendix A: Personal Development links which highlights some of the material that is available to start this journey.

Example Soil Sampling Claim

| Region 1 claimed land | 20% of claimed area | Payment rate per ha | Max soil sampling allowance |

|---|---|---|---|

| 100ha | 20 | £30.00 | £600.00 |

| Item | Unit | Cost | Amount |

|---|---|---|---|

| gathering soil sample | Example: 25 samples | £4.00 | £100.00 |

| soil sample analysis paid invoice cost (net VAT) | Example of actual cost | £450.00 | £450.00 |

| Development time: | £250.00 | £250.00 | |

| Claim 1 | £800.00 | ||

| Claim 2 | £550.00 |

The applicant would be paid £800.00 if it was their first claim or £550.00 if it is their second claim.

Whole farm sampling - claims over multiple years

To cater for businesses that have actual costs that exceed their annual allowance, there is now flexibility to use the same invoice/ supporting information and claim the remaining actual cost up to the maximum soil sampling allowance in the following years.

This is targeted at businesses where they sample all suitable land in one year, with this performed every 4 or 5 years.

In the year that the soil analysis is performed you can claim in the same way as any other claimant with the claim amount restricted to your maximum soil sampling allowance. If this does not cover all your actual costs, there will be an opportunity to claim in subsequent years provided you meet the normal option rules and the points below:

- Supporting documents must be dated after 01/01/2022 and require to be supplied with each claim.

- Invoices from a previous year will only be accepted if you have an associated part claim in that scheme year.

- You can only have one claim for soil analysis per scheme year

- Allowance cannot be carried forward to future years if maximum is not claimed

- You must have a Carbon Audit that meets the option requirement for each claim year

- Sample Gathering costs can only be claimed once

- Personal development payment is only paid with the first claim

- All other soil analysis rules apply

| Region 1 BPS claimed land | 20% of claimed area | Payment rate per ha | Max soil sampling allowance |

|---|---|---|---|

| 100 ha | 20 | £30.00 | £600.00 |

| Item | unit | claimed | amount |

|---|---|---|---|

| GPS sampling performed by contractor |

Example: 100 samples | N/A | N/A |

| soil sample analysis paid invoice cost (net VAT) |

Example of actual cost: £2,500.00 | £2,500.00 | restricted to allowance: £600.00 |

| Development time: | £250.00 | £250.00 | |

| Claim 1, Paid | £850.00 |

| Item | unit | claimed | amount |

|---|---|---|---|

| GPS sampling performed by contractor |

Example: 100 samples | N/A | N/A |

| soil sample analysis paid invoice cost (net VAT) |

Example of actual cost: £2,500.00 | actual cost - previous paid: £1,900.00 | restricted to allowance: £600.00 |

| Development time: | N/A | N/A | |

| Claim 2, Paid | £600.00 |

| Item | unit | claimed | amount |

|---|---|---|---|

| GPS sampling performed by contractor |

Example: 100 samples | N/A | N/A |

| soil sample analysis paid invoice cost (net VAT) |

Example of actual cost: £2,500.00 | actual cost - previous paid: £1,300.00 | restricted to allowance: £600.00 |

| Development time: | N/A | N/A | |

| Claim 3, Paid | £600.00 |

For this example, the applicant would be paid £850.00 for their first claim then £600.00 in subsequent years, not exceeding actual cost value.

Claim process

There is no formal application process to confirm your eligibility for this programme, it is the applicants responsibility to read and digest the guidance below on Carbon Audits and Soil Sampling and Analysis to confirm that they meet the conditions detailed for the option that they are choosing to claim.

Claim must be made online via a new online portal which will be accessed from the Preparing for Sustainable Farming (PSF) guidance page on Rural Payments and Services website.

To submit a claim you will need to:

- have an active Business Reference Number (BRN)

- be registered for funding with the Scottish Government Rural Payments and Inspections Division (SGRPID),

- have completed and paid for the claimed option.

- submit for both Carbon Audits and Soil Analysis an invoice, and a copy of your bank statement to show the payment for the options has been made (see Supporting Evidence)

- provide the date of completion, and the name of the company whose Carbon Audit you or your adviser completed.

- provide the Farm Business Adviser Accreditation Scheme for Scotland (FBAASS) accredited adviser/associate, registration number.

- have the Carbon emissions result of the Carbon Audit measured in Kilos or Tonnes of CO2e, as you need to submit this number as part of the claim.

- To claim for Soil Sampling to improve Nutrient Management Planning (NMP) you should have claimed Region 1 land on your Single Application Form in the year of sampling.

- Have the date of your last Carbon Audit (completed within the last 3 years and aligning with PAS 2050 standards) if you are only wanting to claim for Soil Sampling and Analysis, as this is an eligibility requirement.

- submit a copy of your analysis for every field sampled and any fertiliser recommendations to support your Soil Analysis claims.

- Date of testing and Company details of analysis supplier.

Further details of what needs to be provided are in the relevant option sections.

If you are not registered, do not have an account or do not know your login details, visit Business Registration & Maintenance.

As this is an online only scheme we will send all notifications about the scheme via email. To ensure you receive notifications you should ensure the preferred communication email address SGRPID hold for your business on Rural Payments and Services is correct.

All questions must be answered and the requested data uploaded to allow your claim to be submitted.

If you enter information which is incorrect or in the wrong format, a prompt will appear telling you how to correct this. You will not be able to continue until you have added the information needed.

Claims should be made annually for work that has been completed within the period of 1st January and 31st December.

Invoice must be paid and claim submitted by the claim deadline date of 28th February of the following year with the claim window opening 1st March of each scheme year.

i.e. Carbon Audit completed 25/06/2022 must be claimed before 28/02/2023

Claim window example 1st March 2023 till the 28th February 2024

A separate claim may be made for a Carbon Audit and Soil Sampling or you can claim both at the same time, but you can only make one claim, per option, per claim year.

Please note: claims received late will not be eligible for payment.

How do I claim?

You can now submit a claim for a completed Carbon Audit.

To do this, please press the claim button on this guidance page. This will take you to the easy to use claim portal.

To start your claim you will need your RPS User name and password. If you are an agent who is mandated to claim on behalf of a business, you will be able to select the business you want to submit a claim for after you have entered your details.

The functionality to submit a claim for soil analysis is still under development and will be delivered as soon as possible.

Verification

Processing

The claim process has been designed to ensure that all information is gathered during the online submission to allow your claim to be verified and processed efficiently.

We reserve the right to request additional documentation/ evidence if required and no claims will progress to payment until it is verified and confirmed to meet the requirements of the guidance.

Inspections

Your claim may be selected for inspection before the payment is made, or up to five years after date of claim.

The population of claims selected for inspection will need additional checks to be performed. The inspection rate will be variable starting at a higher level with the intention to drop to our standard inspection rate of 3% once we have proven compliance of the process.

In the same principle as processing we might need to ask for additional supporting information. It is not expected that an inspector will have to visit your holding but there may be communications that need a response to ensure your claim is validated.

No claims will progress to payment before they have been through the inspection selection process and fully checked.

If a claim is not found to be eligible, this may result in your claim being refused.

Request a Review

If you are not satisfied with a decision we have made regarding your claim, you may wish to ask us for a review. When reviewing a case, we can only consider the information that was originally submitted and will not consider new additional documentation.

A request for review must be submitted to your local SGRPID Area Office in writing (including your case reference number) within 14 days of the date on the decision document.

The review request will be considered by an approving officer who was not involved in the original decision. We will respond in writing within 28 days and this will either confirm, amend, or alter our original decision, and explain what the implications of the new decision will be.

Payment

Payments will be made directly into the Sterling bank account registered with SGRPID.

It is your responsibility to make sure a valid and active Sterling bank account for your business has been registered with us on Rural Payments and Services before submitting your claim evidence. Failure to do so will result in your payment being delayed.

All invoices, receipts, accounts and any other relevant documents relating to the claim must be kept for at least seven years from the date of the final payment. This is a HMRC requirement to retain documentation.

All payments will be made Net of VAT.

Please note your claim may be refused if the supporting evidence does not meet the requirement of the option guidance.

We will not be liable for any costs incurred, such as bank charges, by a delayed claim.

Please note that there may be payment interceptions (offsets) if monies are due from over payments of other schemes.

Contract terms and conditions

Additional Information

Contact Details

Please contact your local area office if you have any questions. Customer service details can be found on the Contact us page.

Supporting Evidence

Invoices must:

- individually describe each item being claimed in full

- detail the supplier and the option being claimed

- be addressed to the same business as detailed in the claim, and it must be as the business is registered on RP&S, and on the business bank account.

- show the supplier’s name, address, VAT number and date

- not be from a supplier who is part of, or linked in any way to, the business submitting the claim

Please see the Invoice example below.

Payment Evidence

You will need to provide copies of your bank or building society statement or business credit card statement so that we can confirm all invoices have been paid in full by your business.

For cheque or BACS payments, the cheque number or transfer reference should be visible on the statement.

You must not make cash payments for any claimed items as there isn’t a satisfactory audit trail, and we will not be able to pay for your claim.

Acceptable evidence includes screen shots from an online account showing payment details and bank or building society logos, or a certified report printed from a banking system.

You can blank out other personal information that is not required, but bank or building society statements must still clearly show:

- bank or building society’s name and logo

- account holder name in full

- account number

- sort code

- transaction date

- transaction type (including payee ref/cheque number)

- transaction amount

If you pay for any Items with a credit card, the items must be paid from your business credit card, not a personal account or a different business account. The credit card statement(s) must show that all invoices for claimed options have been paid in full by your business.

Soil Analysis

Paperwork must detail fully all claimed soil samples, which will demonstrate:

- Business details of testing company/ laboratory

- Number of samples

- Analysis details for all mandatory elements; PH level, Phosphate (P), Potash (K) and Carbon

- Recommendations for lime and fertilisers, based upon the crop(s) you intend to grow reflecting Scottish conditions

Appendix A: Personal Development links

Please note this is not a defined list, please refer to local advisors for information and local or Scottish sources of information that will inform you about your business.

Example links:

- PLANET

- Technical notes | SRUC

- Farm Advisory Service

- Advice & Grants | Farm Advisory Service

- Carbon audits | Farm Advisory Service

- Skillseeder

- Farm carbon audits: Why, what and how?

- Farming for a Better Climate

- Technical notes | Farm Advisory Service

- Soils resources for farmers from Farm Advisory Service

- Nitrate Vulnerable Zones: guidance for farmers - gov.scot

- The 4 Point Plan (4PP) - Farming and Water Scotland

- Nutrient Management Plan

- Measuring Soil Health - Farm Carbon Toolkit

- Agriculture | Scotland's soils

- Carbon Assets for Soil Health | Soil Association

- A Practical Guide to Monitoring Soil Carbon

- Potash Leaflets - Potash Development Association (PDA)

- Nutrient Management Guide (RB209) | AHDB

- Climate Change resources for farmers from Farm Advisory Service.

- Nutrient Management Guide (RB209) | AHDB The AHDB nutrient management guide gives good guidance about the principles of nutrient management planning, although it is focused on English conditions and recommendations.

Useful links:

Appendix B: Glossary

| Title | Abbreviation | Description |

| Carbon Audit | CA | Document that gives insights to help reduce your carbon footprint |

| Climate Change Conference of the Parties | COP-26 | Conference about uniting the world to tackle climate change |

| Region 1 land | R1 | Basic Payment Scheme eligible land classification |

| Basic Payment Scheme | BPS | Agricultural support scheme |

| Preparing for Sustainable Farming | PSF | Work stream title |

| National Test Programme | NTP | Government initiative for climate change mitigation |

| Agricultural Reform Implementation Oversight Board | ARIOB | Board consisting of agricultural farms and specialists to advise SG officials |

| Scottish Government | SG | |

| Policy development Group | PDG | Specialist Advisory panel |

| World Trade Organisation | WTO | Deals with the global rules of trade between nations |

| Scottish Government Rural Payment and Inspections Division | SGRPID | Paying agency |

| Business Reference Number | BRN | Number allocated to eligible business to allow claims to be linked to payments |

| FBAASS | Nationally recognised quality assured and accredited registration of advisors that are trained to deliver Carbon audits, list held by LANTRA | |

| Publicly Available Standard 2050 | PAS 2050 | A publicly available specification that will enable you to measure the environmental impact of your organisation |

| Farm Advisory Service | FAS | Scottish consultancy and advice service |

| LANTRA | network of professional training providers | |

| Nutrient Management Planning | NMP | Recognised nutrient management planning process |

| Single Application Form | SAF | Annual form for claiming BPS and other annual recurrent schemes |

| Land Parcel Identification System | LPIS | Mapping system that allows customers to view their farm maps online |

| Her Majesty's Revenue and Customs | HMRS | |

| Green box measure | WTO terminology, subsidies in general are identified by "Boxes" which are given the colours of traffic lights; green (permitted), amber (slowdown be reduced). red (forbidden). |